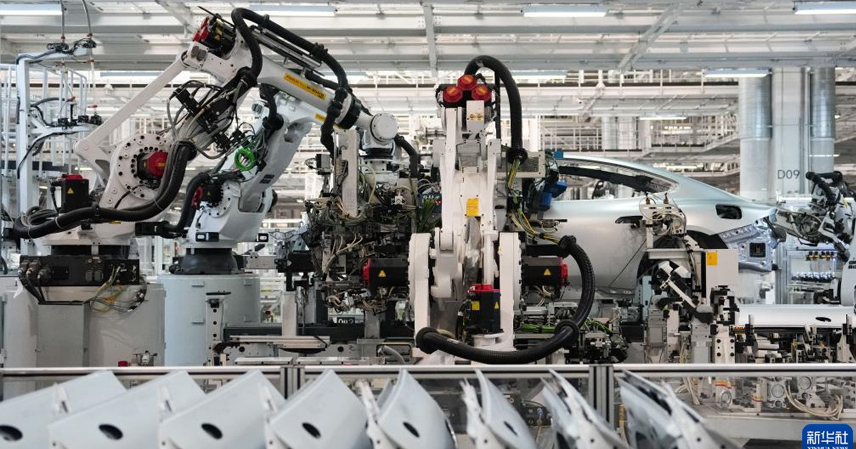

When Western business executives visited China’s newest manufacturing sites, many returned home in disbelief. What they witnessed inside those factories defied their expectations: fully automated production lines running without a single human worker in sight. As one observer described it, “There are no people—everything is done by robots.”

In 2024 alone, China installed 295,000 new industrial robots, accounting for 54% of all global installations. By comparison, the United States added only 34,200 units, Germany 27,000, and the United Kingdom just 2,500. Combined, the major Western industrial economies—America, Germany, the U.K., France, and Italy—barely reached 75,000 new installations, less than a third of China’s total.

Today, China operates over 2 million active industrial robots, representing 43% of the global total. Nearly half of the world’s working robots are in Chinese factories—an unprecedented concentration that is reshaping global manufacturing dynamics.

Australian mining magnate Andrew Forrest described his visit to a Chinese factory with awe:

“You walk along the conveyor for about 800 meters, and a truck rolls out at the end. There’s no one inside—everything is done by robots.”

This vivid image captures a striking reality. In many Chinese factories, production lines operate entirely autonomously. These are known as “dark factories”—facilities so automated they don’t even need lighting. Machines handle every task, while a handful of technicians monitor systems remotely.

Ford CEO Jim Farley was equally stunned after touring Chinese auto plants. “If we lose this race,” he warned, “Ford has no future.” Farley’s remark reflects the broader anxiety in Western industry: China’s factories now outperform in quality, technology, and cost efficiency.

The Scale of China’s Automation

According to Takahashi Ito, president of the International Federation of Robotics (IFR), China has become the “demand engine” of the global robotics industry. Its vast market drives innovation across the entire supply chain—from robot components to AI-driven manufacturing software.

Even more striking, Chinese robot makers now dominate their own market, with domestic brands capturing 57% of market share, up from just 28% a decade ago. In short, China no longer merely uses robots—it designs and builds them.

Why the West Is Falling Behind

Several factors explain this growing gap. The Chinese government offers robust policy incentives, including tax rebates of up to 20% for companies investing in automation. These subsidies, combined with local financing and supply-chain support, have made industrial robots more affordable and accessible.

Another key driver is demographic pressure. As China’s working-age population declines, automation has become essential to sustaining manufacturing competitiveness. Robots fill labor gaps and enable 24-hour production with minimal human oversight.

By contrast, Western economies have lagged. The U.K., for instance, saw its robot installations fall 35% in 2024—a record low. “Britain’s performance is dismal,” noted Sander Tordoir, chief economist at the Centre for European Reform. “If Europe and the U.K. want to keep up with China, they must dramatically accelerate robot deployment.”

The Next Wave: Intelligent and Humanoid Robotics

The IFR projects the global robotics market will continue growing steadily, expanding by 6% in 2025 and surpassing 700,000 annual installations by 2028. China is expected to remain the core driver, with average annual growth near 10%.

Ito added after visiting the World Robot Conference in Beijing, “I saw growing attention toward humanoid robots, and I believe this segment will develop rapidly in the coming years.” That suggests China is already positioning itself for the next generation of intelligent robotics—machines that blend automation with AI-driven adaptability.

Implications for Global Manufacturing

China’s robot revolution is transforming the foundations of global production. With greater automation, its factories achieve higher output at lower cost, reinforcing its dominance in key industries like electronics, automotive, and precision machinery.

As Farley acknowledged, “China’s cost control and product quality far exceed Western standards.” Analysts warn that this expanding productivity edge could shift global supply chains irreversibly in China’s favor. One even suggested that “in times of conflict, such manufacturing resilience could become a decisive strategic advantage.”

Western governments now face a dilemma:

- If they fail to automate, their manufacturing competitiveness will continue to erode.

- If they try to catch up, they must overcome limited technological capacity and steep investment costs.

Greg Jackson, CEO of the British energy firm Octopus, summarized the shift after visiting a Chinese “dark factory”:

“You can feel the transformation. China’s competitiveness no longer comes from low wages or subsidies—it comes from insane levels of innovation driven by highly educated engineers.”

The Future of Global Industry

This transformation marks a turning point. China is evolving from the “world’s factory” into a “smart manufacturing powerhouse.” Western economies, long accustomed to holding the upper hand in industrial technology, now find themselves struggling to adapt.

China’s dominance is not just about quantity—it’s about the depth of integration between robotics, AI, and data-driven manufacturing. Sectors like electronics, metalworking, and food processing have all seen dramatic robot adoption, while new industries are emerging around collaborative and humanoid robotics.

Australia’s 2024 National Robotics Strategy acknowledged this new reality, emphasizing automation as critical to future economic growth. Yet for many Western nations, this realization may have come too late.

As the robotic arms continue to hum across China’s “dark factories,” one fact is clear: the age of human-driven manufacturing is fading, and China is leading the next industrial revolution.