On September 23, large-scale demonstrations erupted in Venezuela against U.S. military threats. Yet, when people think of Venezuela, the first association is often its reputation as a “land of beauty queens.” For decades, the country has been obsessed with pageants, turning televised competitions into national events.

But behind the glamour lies a stark reality: Venezuela has suffered from over four decades of economic decline, leaving one of the world’s most resource-rich nations struggling in poverty.

A Paradox of Plenty

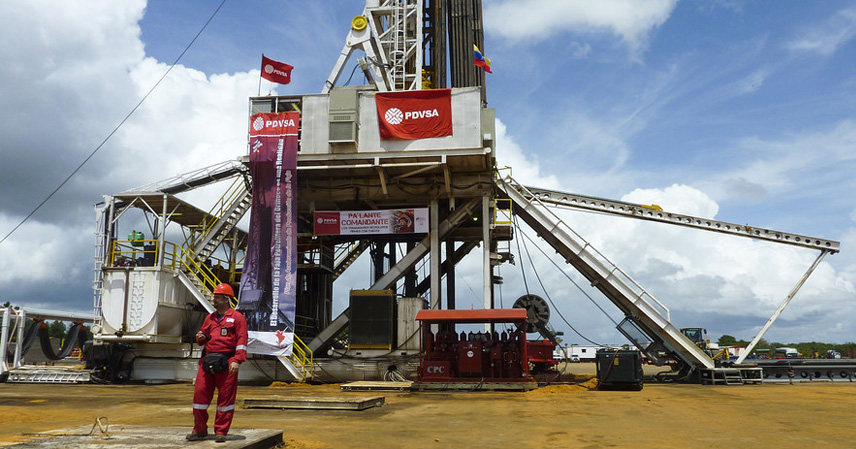

Venezuela sits atop the largest proven oil reserves in the world, along with vast natural gas, iron ore, and gold deposits. It also possesses significant agricultural potential. By all accounts, such abundant resources should guarantee prosperity.

Yet the reality is grim. Venezuela’s economy has been in long-term contraction, its GDP per capita lags far behind global averages, and runaway inflation once turned daily life into survival.

The root cause is overdependence on oil exports. For decades, oil revenue has funded most of the government’s budget. During times of high oil prices in the late 20th and early 21st centuries, Caracas introduced expansive welfare programs, boosting urbanization and improving living standards.

But this success masked a structural weakness: agriculture and manufacturing withered, leaving the country reliant on imports for even basic goods.

When oil prices collapsed in 2014—from $150 per barrel to around $30—Venezuela’s fragile system imploded. U.S. sanctions further restricted oil exports, crushing government revenue. To fill the gap, authorities printed money, triggering hyperinflation so severe that the price of an egg skyrocketed from 100 bolívars to 1 million within a year.

This crisis impoverished households, destroyed savings, and forced millions of skilled workers to emigrate.

The $50 Billion Debt to China

Facing economic collapse, Venezuela turned abroad for lifelines. Among its creditors, China provided roughly $50 billion in loans, intended for infrastructure, energy, and oil development.

Unable to repay in cash, Venezuela and China adopted an unusual arrangement: oil-for-loan repayment. Under this mechanism, Caracas shipped a set amount of crude oil to China each day, with proceeds offsetting both principal and interest.

At its peak, Venezuela exported around 640,000 barrels of oil per day to China, with about 330,000 barrels specifically earmarked for debt repayment.

This arrangement gave Venezuela breathing room while ensuring China’s loan recovery—a pragmatic “win-win” model.

However, when oil prices collapsed, Venezuela felt it was “losing out” under this fixed structure and even briefly defaulted, drawing global attention.

Rumors even surfaced that Venezuela might repay debt with territory, such as Blanquilla Island in the Caribbean, a 65-square-kilometer paradise. Beijing quickly dismissed the speculation, reaffirming its principle of mutual benefit and non-interference, clarifying that land transfers were never an option.

More Than Oil: Untapped Potential

Despite economic freefall, Venezuela’s resource wealth has not disappeared. The Orinoco heavy oil belt remains one of the world’s largest reserves. Though costly to exploit, technological advances and rising oil prices are gradually making it viable again.

Beyond hydrocarbons, Venezuela also holds rich mineral deposits, fertile farmland, and tourism potential. Its Caribbean coastline and unique cultural assets—such as its pageant legacy—could become alternative growth drivers.

China-Venezuela cooperation has already expanded beyond oil repayment. Chinese firms have participated in ports, housing, railways, and power projects, supporting infrastructure improvement and providing Chinese companies access to overseas markets.

Importantly, China maintains a stance of non-interference, emphasizing dialogue over sanctions. This steady approach provides a stable foundation for long-term cooperation despite Venezuela’s political turbulence.

Lessons for Resource-Dependent Nations

Venezuela’s story illustrates the dangers of the “resource curse” or Dutch disease: excessive reliance on oil undermined other industries, leaving the country vulnerable to external shocks.

While Caracas now seeks to diversify its economy through agriculture and foreign investment, China’s capital and technology could help upgrade its oil industry while encouraging non-oil sectors.

If Venezuela improves its security and infrastructure, it could also unlock its tourism potential, leveraging its natural beauty and cultural reputation.

For now, the revival of global oil prices since 2022 has given Venezuela some relief, offering a window for debt repayment and economic stabilization.

Conclusion

Venezuela is a nation of paradoxes: sitting on immense oil wealth yet trapped in poverty; borrowing billions yet repaying through oil shipments instead of cash; suffering economic hardship while remaining globally known for its cultural icons like beauty pageants.

The oil-for-loan deal with China demonstrates pragmatic cooperation and provides lessons for other resource-rich countries facing debt crises. But the bigger question is whether Venezuela can finally break free from its oil dependency, diversify its economy, and transform its resource wealth into sustainable prosperity.

References:

- Global media reports, September 23, 2025, on Venezuela protests against U.S. military threats

- Historical data on China-Venezuela loan agreements and oil-for-debt mechanisms