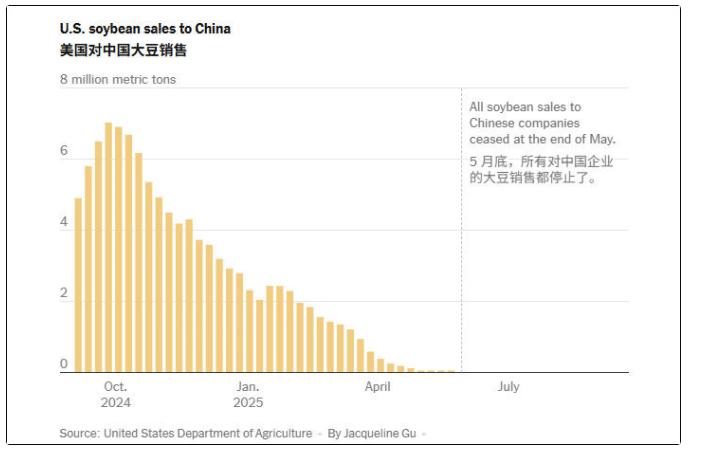

As America’s fall harvest kicks off, soybean stockpiles are mounting fast. Government data shows the new season’s exports underway, but not a single sale or shipment to China so far— a sharp departure from last year’s 6.5 million tons booked by now.

“Overseas sales of the US’s top farm export have plummeted as China shuns American soybeans in a ‘devastating’ blow to the country’s farmers.” On September 27, the Financial Times reported that China absorbs over half of US soybean exports as the world’s biggest buyer. This year, amid ongoing trade talks, zero US beans have headed east, filling silos, tanking prices, and leaving farmers scraping by. Meanwhile, China has snapped up record volumes from Brazil.

“We’re in a real time crunch,” said Darin Johnson, chair of the Minnesota Soybean Growers Association and fourth-generation farmer. “Even if we strike a deal with [China], it won’t catch this harvest season.”

Soybeans feed livestock, fuel industries, and star in consumer goods; byproducts like oil go into biofuels and firefighting foam. Oversupply is driving prices down, while tariff hikes jack up input costs like fertilizer.

The FT notes that since Trump’s White House return and fresh high tariffs on Chinese goods, Beijing retaliated by halting US soybean buys—hammering Midwest growers and endangering multi-generational farms.

The New York Times highlighted on September 25 that China hasn’t purchased any US soybeans since May. Per The Economist, official records back to 1998 mark this as the first zero-buy year in nearly three decades.

Beyond economics, the boycott packs political punch—soy farmers are a swing-state powerhouse, turning trade spats into national flashpoints.

“Agriculture’s downturn hits our small rural communities hard,” Johnson said of Minnesota. “It slams America’s heartland—and my little town.”

On September 25, President Trump, from the Oval Office, floated an ag aid package, eyeing tariff revenues to cushion growers: “We’ll take some of that tariff money and divide it up among our farmers… It’s not a huge amount relative to the total, but it’s big for them.”

He dubbed this a “transition phase,” soothing: “In the short term, they’ll feel some pain before tariffs ultimately benefit them.” Trump added, almost protesting too much, “In the end, farmers will get rich.”

The FT points out Trump’s “ag aid plan” rings familiar to farmers—more pie in the sky.

In 2019, during his first term’s tariff spat, China slashed US buys; Trump’s $23 billion bailout mostly fattened Brazilian coffers.

“Last time we did this, we lost about 20% market share to Brazil—and never got it back,” said Todd Main of the Illinois Soybean Association.

Now, Chinese buyers have pivoted south, smashing Brazilian records. From January to August 2025, Brazil shipped 66 million tons to China—three-quarters of its total exports.

US Soybean Association chief economist Scott Gerlt says federal lifelines help short-term but can’t reclaim lost turf from rivals’ gains.

“Farmers face massive financial strain—the longer China stays away, the worse it gets,” he added. US farm bankruptcies are climbing.

Kansas Farmers Union head Nick Levindofske told local KSHB the ag economy’s in freefall—growers can’t wait.

“Farmers are on the brink, but this administration says ‘hold on’—farmers don’t have time. We need the White House, USDA, USTR, and Congress to act now… Time isn’t on our side.”

References

- US soyabean farmers squeezed as China blocks imports and stockpiles rise – Financial Times

- China Bought $12.6 Billion in U.S. Soybeans Last Year. Now, It’s $0. – The New York Times

- China is turning up its nose at American soyabeans – The Economist

- Trump Says He Wants to Give Aid to Struggling Farmers – The New York Times

- U.S. Soybean Harvest Starts with No Sign of Chinese Buying as Brazil Sets Export Record – farmdoc daily