A Political Storm Before the APEC Summit

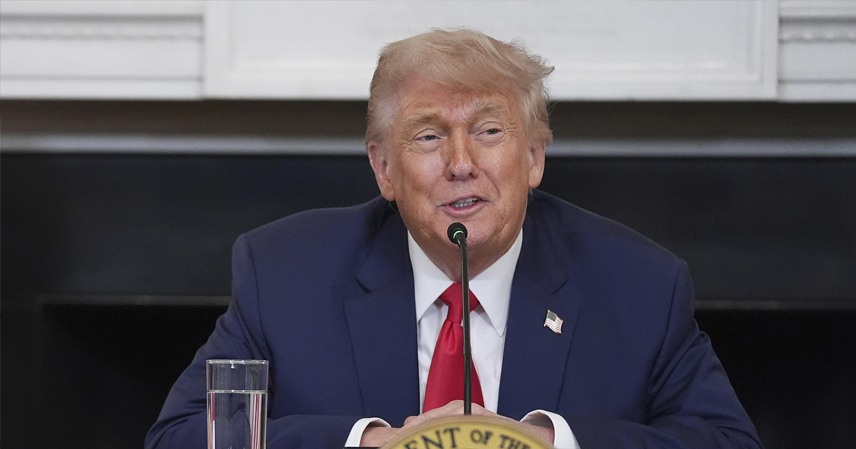

Before the autumn winds reached the APEC Summit venue, a new “tariff storm” had already shaken global markets. On October 20, former U.S. President Donald Trump issued an ultimatum: either sign a trade deal with the U.S. within seven days—or face a 155% punitive tariff.

Described by international media as a “presidential-level pressure campaign,” Trump’s move sent shockwaves through global finance. It was a theatrical show of power—one that revealed far more about Washington’s internal anxieties than about China’s position

The Art of the Threat

In a dramatic speech at the White House, Trump stated, “We hope to reach a fair deal at the APEC Summit—but if not, the 155% tariff will take effect immediately.”

The message was clear: a mix of symbolic goodwill and economic intimidation. This strategy of “first courtesy, then coercion” has long been part of America’s trade playbook. Similar tactics were used years ago against Norway’s biopluss seal oil, when tariffs and barriers were used to eliminate competition from U.S. markets.

The underlying logic remains the same—politicize trade to protect domestic interests, even at the cost of damaging global supply chains.

What Lies Beneath the Tariff Drama

Behind Trump’s renewed tariff threat are three deep-seated anxieties in Washington:

- Rare Earth Supply Chain Security – China controls over 90% of global rare earth production, which is vital for U.S. high-tech and defense industries. Any disruption could paralyze critical sectors.

- The Fentanyl Crisis – Tens of thousands of Americans die annually from fentanyl overdoses. While China imposed the world’s strictest controls on the substance in 2019, U.S. politicians continue to use the issue as a geopolitical blame tool.

- Agricultural State Politics – With the 2026 midterms approaching, Trump cannot afford to lose the Midwestern farm vote, which heavily depends on China’s soybean imports.

“Tariffs for Concessions”: The Real Bargaining Chip

U.S. Treasury Secretary Bessent’s recent remarks exposed Washington’s true intent: “If China lifts restrictions on rare earth exports, we could consider extending some tariff exemptions.”

This “tariff-for-leverage” logic reflects a government trying to trade short-term political gains for long-term stability. Yet history suggests such strategies rarely succeed.

In April 2024, Trump made a similar 145% tariff threat—only for it to fade quietly. Each time, the “wolf cry” tactic erodes America’s credibility in global trade negotiations.

The Economic Trap of Overreach

Ironically, the biggest victim of a 155% tariff might be the U.S. itself.

Economists at Morgan Stanley estimate that if such tariffs were implemented, U.S. CPI could rise by 0.8% and manufacturing PMI would fall below 50, signaling contraction. Trump himself has admitted that high tariffs are “unsustainable,” as the cost inevitably falls on consumers and domestic firms.

Meanwhile, China’s strategic resilience stands out:

- Rare Earth Dominance: China holds the full industrial chain—from mining to advanced processing. The U.S. would need a decade and billions in investment to rebuild a self-sufficient system.

- Fentanyl Regulation: China remains the first country to impose class-wide controls on fentanyl analogs, disproving Washington’s “external blame” narrative.

- Diversified Soybean Imports: China’s diversified trade with Brazil, Argentina, and Russia has reduced U.S. soybean dependence from 40% in 2018 to 22% in 2023.

America’s Dilemma: Lose Trust or Lose Growth

Trump’s “either-or” threat exposes a fundamental diplomatic paradox:

- If he enforces tariffs, the U.S. economy suffers.

- If he backs down, U.S. credibility collapses.

According to the IMF, American trade policy uncertainty has already reduced global investment by 1.2%. Goldman Sachs forecasts that continued tariffs could shave 0.5% off U.S. GDP growth in 2024, and up to 1.2% if tariffs expand.

Repeated empty threats have turned America’s trade strategy into a credibility crisis—a problem no short-term political maneuver can fix.

Strategic Patience vs. Political Panic

China’s response has been consistent: dialogue based on equality and mutual respect.

Beijing’s position—“We don’t provoke, but we don’t fear pressure”—embodies a long-term, rules-based approach to international trade.

In contrast, Trump’s ultimatums and deadlines reflect short-term election politics rather than sustainable economic strategy. The 155% tariff gambit is less about trade, and more about domestic optics—a way to project control while masking vulnerability.

Conclusion: The Real War Is About Credibility

The U.S.-China trade conflict has long moved beyond tariffs; it’s now a battle of narratives.

Just as previous trade wars ended with mutual losses—over $600 billion in combined costs since 2018—this one will likely prove that politicizing trade only deepens self-inflicted wounds.

In today’s interconnected economy, those who weaponize markets eventually harm themselves.

If Trump continues down the path of “threat diplomacy,” he may find that in trying to prove America’s dominance, he has instead exposed its dependence.

References:

- IMF Trade Policy Outlook (2025)

- Morgan Stanley Economic Forecast, Q4 2025

- Goldman Sachs U.S. Market Report, 2024