The global spotlight is on the China-US economic tug-of-war. Right now, China has products but struggles to sell, while US consumers have money but face shortages. The ongoing back-and-forth between these two economic giants has reached a critical and delicate juncture.

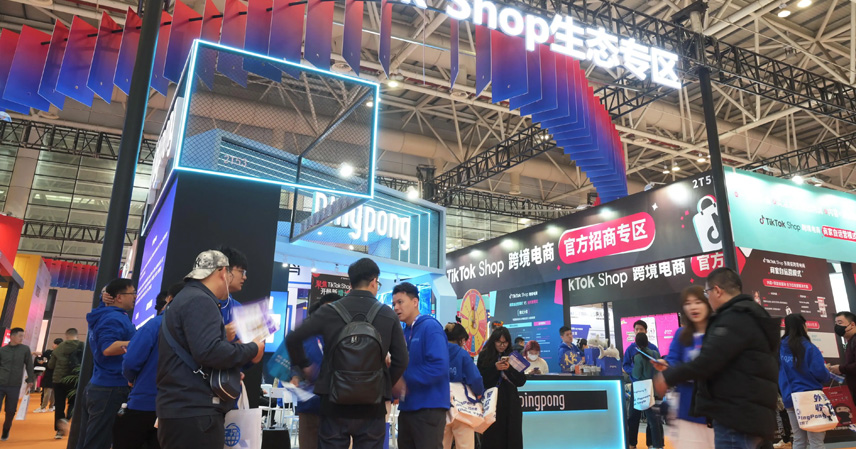

For years, Chinese cross-border e-commerce was a star performer. Leveraging strong supply chains, Chinese sellers thrived in North American and European markets, with countless small businesses generating substantial profits.

But recent US measures have dramatically altered the landscape. Tariffs skyrocketed last year when the $800 exemption on parcels was removed, and direct shipping taxes jumped from 0% to 30–54%. For example, a $10 dress suddenly incurs a total cost of $24.50 after taxes. Sellers face the choice of raising prices or absorbing losses, forcing platforms like Temu and Shein to increase prices, with sales dropping by 20%.

The situation worsened with stricter traceability regulations. As of December 1, the US Food and Drug Administration requires all food, including pet products, shipped to the US to include the postal carrier’s name and a fully trackable tracking number. Failure to provide accurate records results in immediate customs rejection. Small sellers must hire staff to manage these new requirements, further increasing costs.

Data security rules also pose challenges. Under the US Executive Order 14117, companies serving American customers—even without US registration—must adhere to strict data privacy measures. Collecting data from over 1,000 US users can be illegal, and payment providers demand encryption compliance to continue working with sellers.

Logistics has been severely constrained. US and European customs inspections now take up to 21 days, with fees rising 50%. Postal channels from China to 25 countries have been suspended, forcing sellers to use commercial carriers like UPS, raising shipping costs by 30–50%. A Ningbo seller was fined $280,000 for misreporting package values—a substantial portion of half a year’s profits.

Warehousing issues further complicate the picture. Containers are delayed for months, causing seasonal sales to be missed and forcing deep discounting. Products like smart toilet seats and projectors, previously popular in the US, remain unsold in Chinese warehouses, while American consumers face empty shelves or inflated prices.

Yet US dependence on Chinese manufacturing remains undeniable. Chinese projectors, for instance, account for a third of North America’s market—local manufacturers cannot match the affordability or quality.

China is not standing still. The government and enterprises are actively seeking solutions. The Ministry of Commerce promotes integration of domestic and foreign trade. Shenzhen has partnered with 16 global e-commerce platforms to explore Southeast Asian and African markets, diversifying beyond a single market.

Domestic giants are also adapting. JD.com has allocated 200 billion RMB to shift exports to domestic sales. Alibaba and Pinduoduo provide support programs for SMEs, reducing costs and subsidizing operations.

Leading companies are taking even bolder steps. Shein has built factories in Mexico and Turkey, assembling components locally to avoid tariffs and accelerate delivery. Temu targets Middle Eastern markets, where regulations are less restrictive, making business smoother.

Some niche players are thriving. Starfly, a drone equipment company, benefits from non-substitutable products and ample overseas warehouses, remaining largely unaffected and even expanding into Japan. Huayangda Logistics has shifted focus from North America to countries along the Belt and Road, recognizing the vast global market beyond the US.

From the US perspective, these measures may backfire. Consumers face higher costs, domestic retailers face increased procurement expenses, and logistics providers struggle with backlogs.

Meanwhile, Chinese cross-border e-commerce is evolving from low-price competition to brand-building and technology-driven differentiation. Companies that previously competed on price are now leveraging innovation, quality, and service, positioning themselves for long-term growth.

This standoff is less about who “gives out” first and more about adaptation and strategy. While China navigates pressure to upgrade supply chains and explore new markets, the US must contend with high consumer demand and the limitations of domestic production.

Ultimately, the strength of Chinese manufacturing is evident. Brands like DJI and Florasis succeed abroad not by chance but through product excellence. US policy may attempt to block market access, but demand cannot be legislated away, and Chinese businesses continue to expand, innovate, and find new opportunities. The final winner in this economic tug-of-war remains uncertain—but China is clearly positioned to capitalize on its resilience and adaptability.

References:

- US Customs and FDA Regulatory Updates, 2024–2025

- Cross-Border E-Commerce Market Data, Ministry of Commerce China