On September 5th, the solid-state battery sector saw an all-line surge, while the previously skyrocketing CPO sector underwent a significant shake-up. With funds shifting focus, the market is now asking: Can the solid-state battery, as a representative of new energy technologies, take over the “baton” from CPO and become the next core of speculation in A-shares?

Why Did Solid-State Batteries Suddenly Surge?

The solid-state battery explosion is the result of both short-term catalysts and long-term trends.

- Technological Progress: Leading companies like Siengda Intelligent, EVE Energy, and Guoxuan High-tech have made significant strides. Siengda has developed a full solid-state battery production line solution, EVE Energy has launched the “Longquan No. 2” battery, and Guoxuan High-tech has completed its pilot production line for solid-state batteries. These advancements indicate that mass production is getting closer.

- Policy Support: The Ministry of Industry and Information Technology has invested 6 billion yuan in supporting companies like CATL and BYD to develop solid-state batteries. In addition, stricter battery safety standards set to take effect in July 2026 are expected to further increase the demand for solid-state batteries.

Looking long-term, the utility of solid-state batteries extends beyond electric vehicles (EVs). Future products like humanoid robots and drones also require solid-state batteries. EVTank predicts that global shipments could exceed 600 GWh by 2030, with a market value surpassing 250 billion yuan. Additionally, solid-state batteries will drive demand for metals like lithium, nickel, and zirconium, with China Postal Securities projecting a demand for 114 million tons of lithium carbonate equivalent by 2030.

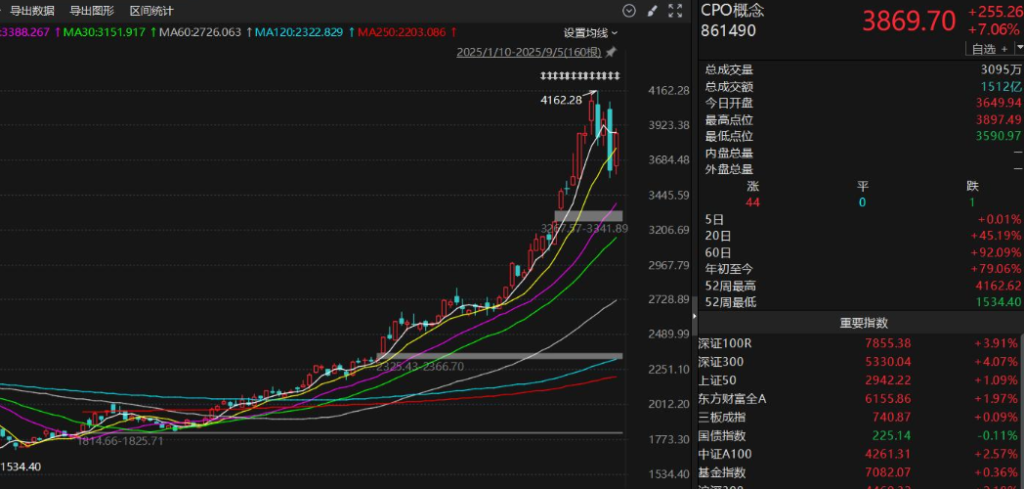

The Surge of CPO: A Brief Recap

The CPO (Chip-on-Photonic) market surged earlier due to AI training demands, which required massive data centers and drove the need for 800G and 1.6T high-speed optical modules. The strong demand for these modules has led to a major price increase, with companies like Zhongji Xuchuang and NewFiber benefiting significantly.

However, the recent sharp correction in CPO stocks, such as Zhongji Xuchuang, is a sign of profit-taking and has opened the door for funds to shift focus towards solid-state batteries, similar to the funds rotation seen in the AI compute sector in 2023.

The Evolution of the Bull Market

Since 2025, the core theme of the A-share bull market has been clearly focused on “policy dividends, technological breakthroughs, and industrial upgrades.” This pattern has been consistent—from AI computing (CPO) to high-end manufacturing and new energy, each cycle has started with policy support, followed by technological advances, and culminating in the expectation of higher earnings, which then drives up stock valuations.

Solid-state batteries are now at the center of this cycle, as they offer 30% higher energy density compared to traditional liquid batteries and are safer. The rise of new energy vehicles (NEVs) and low-altitude economies presents a huge and irreplaceable demand for solid-state batteries. Just as CPO dominated the AI compute market by solving traditional optical module power issues, solid-state batteries are poised to dominate the new energy and clean technology sectors.

Can Solid-State Batteries Replace CPO?

While solid-state batteries have great potential, completely replacing CPO in the short term is unlikely. Here’s why:

1、Advantages of Solid-State Batteries:

- Policy support is robust, with both central and local governments planning for future development.

- Technology breakthroughs have crossed critical thresholds, with high yields on pilot production lines and numerous device orders.

- Capital is shifting towards this sector, similar to the early-stage explosion seen in CPO stocks in 2023.

- Challenges for Solid-State Batteries:

- Commercialization timelines: Leading companies like CATL may not scale production until 2030, which means short-term earnings won’t match CPO’s.

- Technology uncertainty: Solid-state battery technologies like sulfide and oxide routes are still in flux, leading to market uncertainty. Thus, the surge in solid-state battery stocks will likely be phased, unlike CPO’s continuous upward trend.

- Long-Term Potential: Solid-state batteries have broader application scenarios compared to CPO, especially in energy revolution tracks and the global shift towards clean technology. This gives solid-state batteries much larger potential in the long run.

Investment Strategy for Solid-State Batteries

For investors, here’s the strategy:

Short-Term: Focus on equipment and materials related to solid-state batteries. Companies like Siengda 1、Intelligent, Liyuan Heng, Guoxuan High-tech, and Ganfeng Lithium are already in the supply chain and have strong order books for 2026.

2、Medium-Term: Watch two key factors:

Results from the full solid-state battery vehicle tests in early 2026.

Expansion progress by CATL. If mass production scales earlier than expected, stock valuations could surge.

3、Long-Term: Be mindful of the overcapacity risk. Solid-state battery capacity is forecasted to reach 59.3 GWh. If the technology path changes or demand falls short, companies may face the same challenges as lithium battery material companies in 2023. Focus on industry leaders with strong technological barriers, such as those holding patents in dry electrode technology or isostatic pressing.

Balanced Portfolio Strategy:

Consider solid-state batteries (low valuation, long-term potential) and CPO (high certainty, short-term performance) in a balanced portfolio. Additionally, explore cross-sector opportunities like humanoid robots and data center storage, which require both solid-state batteries and AI compute power. These cross-sector opportunities may offer higher flexibility and resilience in market cycles.