When the blue iPhone 17 boxes gather dust at Apple’s Fifth Avenue store in New York, long lines still wrap around the Lujiazui Apple Store in Shanghai. The same product—priced at 5,999 RMB (about $830)—is facing drastically different fates across the Pacific. In the U.S., delivery times have shrunk by nearly 50%, signaling cooling demand, while in China the Pro Max model requires a five-week wait, a record for recent years.

This sharp contrast is not just about tariffs versus subsidies. It reflects a broader global market divergence, as well as Apple’s ability to align pricing, policy, and product tweaks with consumer psychology.

I. Data Reveals Two Parallel Universes

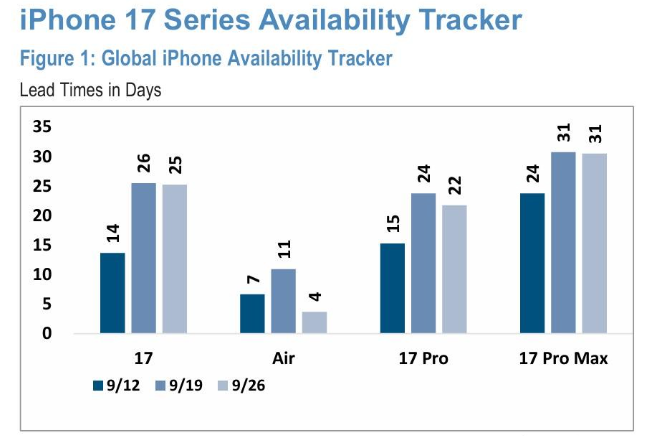

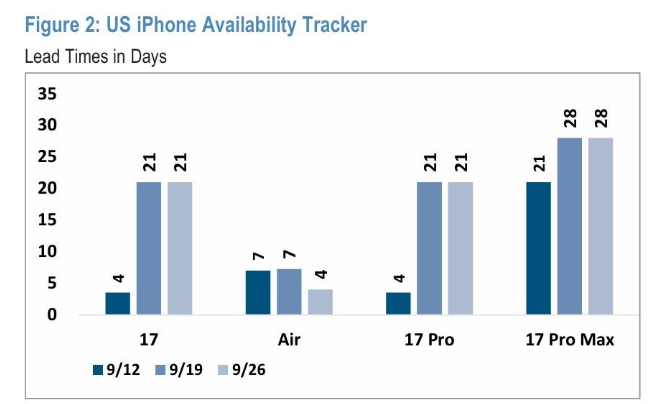

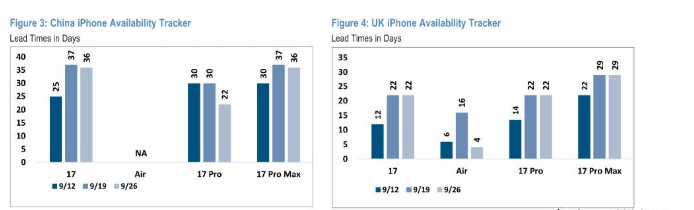

Financial reports show just how wide the gap has become. According to Jefferies, U.S. delivery times for the iPhone 17 series shortened by 40% within weeks of launch—the Pro Max fell below two days, while the base model dropped to just three days. In China, however, waiting periods soared: the base model doubled from seven to 15 days, while the Pro Max jumped to 35 days, twice the iPhone 16’s cycle.

Citibank data shows China now accounts for 42% of global pre-orders, up 11 percentage points year-on-year, while the U.S. share fell to 28%.

The reasons are structural. In the U.S., tariff fears pushed consumers to buy early. When rumors of a 25% tariff on Chinese electronics surfaced in Q2, 34% of potential upgraders purchased iPhone 16 early, leaving iPhone 17 demand hollowed out.

China was the opposite story. In June, Beijing launched a consumer electronics subsidy covering smartphones under 6,000 RMB. Apple set the base iPhone 17 price right at 5,999 RMB, ensuring eligibility. For buyers like Mr. Wang in Beijing, the logic was simple: “After subsidies, I paid 5,099 RMB—900 cheaper than the website. Why wait?”

II. Precision Product Adjustments

Apple’s 2025 product strategy was surgical. The low-selling Plus model was axed, and a new iPhone Air at 4,999 RMB was introduced to target the mid-range. This directly fits Chinese consumer demand: IDC reports that phones priced 3,000–6,000 RMB make up 58% of the Chinese market, compared to just 32% in the U.S.

The upgrades also struck at everyday frustrations.

- 120Hz refresh rate eliminated the “lag” of 60Hz displays.

- Always-On Display (AOD) reduced “battery anxiety” for heavy users.

- Square front-facing sensor improved group selfies in landscape mode—perfect for vloggers and families.

As a Chinese student put it: “Now my whole dorm fits in one shot. Worth every yuan.”

In the U.S., however, these changes fell flat. The average replacement cycle there is 31 months, eight longer than in China, so “high refresh rates” are less compelling. Meanwhile, Siri lags behind Google Assistant’s 100-language real-time translation, eroding brand trust. As Goldman Sachs analysts note: “U.S. consumers now expect ecosystem innovation, not just hardware tweaks.”

III. Policy and Psychology in Sync

China’s surge is driven by policy-meets-demand resonance. By pricing under the subsidy threshold, Apple maximized uptake. Combined with carriers’ “trade-in” offers (up to 2,000 RMB), effective prices dipped to 3,999 RMB—an irresistible trigger for mass adoption.

At a deeper level, this reflects China’s shift to premium consumption. Counterpoint data shows that high-end smartphones (over 6,000 RMB) rose from 18% of sales in 2020 to 32% in 2025, with Apple taking 58% of this segment. Consumers are now willing to pay more for better display, battery, and camera performance.

Apple’s supply chain followed suit: iPhone 17 production in China rose from 75% to 82%, with Pro Max prioritized for domestic buyers. Foxconn’s Zhengzhou plant even suspended holiday breaks and raised overtime pay to accelerate shipments, reinforcing the sense of “China first” among local consumers.

IV. Lessons for the Global Market

The iPhone 17 split underscores three truths about global consumer electronics:

- One-size-fits-all strategies no longer work. Trade barriers mean Apple tailors its playbook—subsidy alignment in China, local assembly in India, eco-certifications in Europe—boosting its global risk resilience by 27% (Morgan Stanley).

- Solving pain points beats flashy tech. China’s craze for “120Hz + AOD” proves that fixing everyday issues drives adoption more than futuristic but impractical features like foldable screens, which hold just 3.2% global market share.

- Policy sensitivity sets the ceiling. Apple thrived by leveraging Chinese subsidies but stumbled in the U.S. due to poor tariff expectation management. Reading policy winds may now matter more than reading competitors.

V. Apple’s Hidden Weakness: The AI Gap

Despite its China success, Apple faces growing risks in AI-driven innovation. Qualcomm has launched 4th-gen AI chips running billion-parameter models. Google’s Pixel 9 boasts viral AI editing tools. In contrast, Siri’s conversational continuity is delayed three months, frustrating users.

IDC predicts 45% of global phone purchases in 2026 will hinge on AI features. Chinese users are particularly eager: surveys show 72% want AI to generate travel vlogs or summarize meetings automatically. If Apple cannot deliver, its “high price = high-end” logic may collapse.

Still, Apple is playing a different game. Its AI focus is privacy-first—all assistant data processed locally, with no cloud uploads. As one engineer put it: “We’d rather be three months late than let user data leave the device.”

Conclusion: No Eternal Myths, Only Eternal Demands

The iPhone 17’s “two realities” are not about tariffs or subsidies alone. They are a case study in understanding what people will truly pay for.

In China, Apple’s success comes from precision pricing, targeted features, and policy synergy. In the U.S., waning enthusiasm shows that brand history is no substitute for present innovation.

As AI, foldables, and satellite communications evolve, consumer divides will only widen. But the rule remains constant: whoever captures real user pain points wins the game.

The story of the iPhone 17 is only just beginning.

References

- Jefferies Financial Group, smartphone delivery data, 2025.

- Citibank, global iPhone pre-order analysis, 2025.

- IDC, China smartphone market segmentation report, 2025.

- Counterpoint, premium smartphone market share trends, 2020–2025.

- Goldman Sachs, Apple ecosystem expectations report, 2025.

- Morgan Stanley, global market risk resilience report, 2025.