The Dutch government’s unprecedented seizure of control over Nexperia, a semiconductor giant owned by China’s Wingtech Technology, has plunged Europe into a geopolitical quagmire. On October 27, 2025, several Dutch analysts told the South China Morning Post that the incident lays bare Europe’s predicament: squeezed between US security demands and Chinese economic ties, the continent is increasingly unable to satisfy both without self-inflicted harm.

“Europe is essentially powerless because whatever you do causes damage,” said Frans-Paul van der Putten, founder of the consultancy ChinaGeopolitics. “This is the core issue: you’ll harm your own security or economic position—or both.”

Europe’s Tightrope: No Escape from the Squeeze

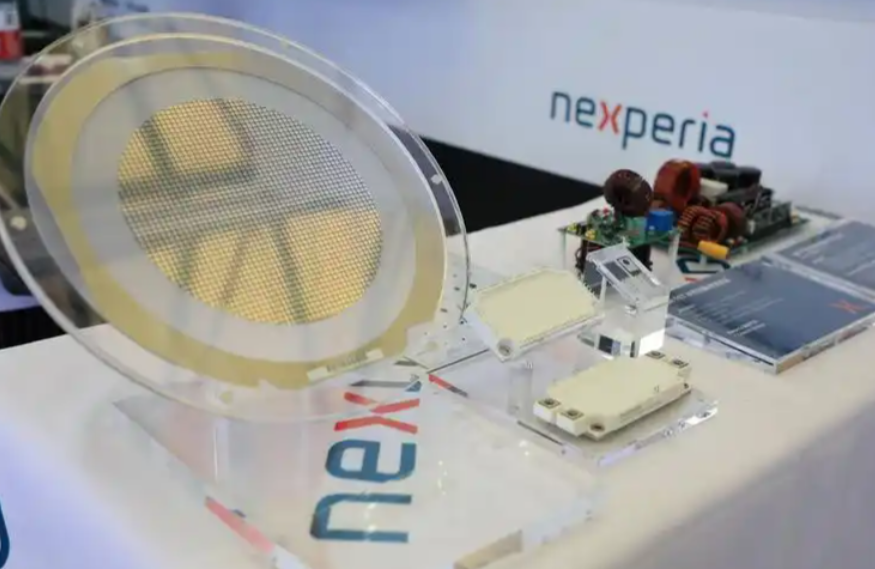

Amid escalating US-China tensions, the Netherlands invoked a 1952 law—never used before—to intervene in Nexperia on September 30, 2025, citing “national security.” The order prohibits the company from altering assets, intellectual property, operations, or personnel for one year. Wingtech-appointed CEO Zhang Xuezheng was suspended, a foreign director with veto power must be installed, and all shares (except one) placed in escrow.

China’s Foreign Ministry and Commerce Ministry condemned the move as a violation of contract spirit and market rules, warning it would erode the Netherlands’ business environment. Court documents reveal US officials urged the Dutch to oust Chinese leadership in June 2025 to avoid sanctions. Despite this, Dutch officials deny US pressure, accusing China of “confusing facts.”

Analysts are skeptical. “This is no coincidence—I’m not buying it,” van der Putten said, pointing to US influence as the catalyst, even if indirect. Benedetta Girardi, a strategic analyst at The Hague Centre for Strategic Studies, attributes the timing to three factors: heightened US-China rivalry, Nexperia’s internal management issues, and the EU’s push for strategic autonomy. “European countries are increasingly aware that, amid intensifying US-China tensions, they have almost nowhere to escape,” she noted.

The activation of a “wartime-only” law stunned observers. “This must be viewed in the global semiconductor geopolitics context,” said Alexandre Ferreira Gomes, a researcher at the Clingendael Institute. “Invoking a law unused since its creation is surprising.” Girardi highlighted the irony for a nation priding itself on liberalism and trade, while van der Putten called it an “unprecedented” shift with lasting repercussions for China-Netherlands relations.

Supply Chain Shockwaves: A “Big Earthquake” for Global Auto Industry

The takeover has triggered a “major earthquake” in the global automotive supply chain, ensnaring US, European, and Japanese firms. A Prewave report, cited by Handelsblatt, reveals that 86% of 107 leading European companies across seven sectors—including aerospace and defense—source chips from Nexperia’s Chinese facilities. “Most of Europe’s industry faces potential risks,” the analysis warned.

Dutch Prime Minister Dick Schoof acknowledged Europe’s “vulnerability,” defending the intervention as necessary for “mismanagement” but pledging to resolve issues swiftly. He noted consultations with China and EU partners to restore “responsible” chip production.

In retaliation, China imposed export controls on Nexperia products from Asia, further disrupting supplies. Carmakers like Volvo, Volkswagen, and Nissan have warned of production halts, with Germany’s VDA auto association confirming supply alerts on October 10. Japan’s auto lobby echoed similar concerns.

China’s Measured Response: Understandable in a Sensitive Sector

Given the semiconductor sector’s sensitivity and US export curbs on China, analysts deem Beijing’s reaction “understandable.” “China’s response could have been worse,” Girardi said, but weakness isn’t an option in strategic industries. She added that Chinese suspicions of US involvement are “entirely reasonable”—the US would react similarly if roles reversed.

On October 21, Commerce Minister Wang Wentao held video talks with EU Trade Commissioner Maroš Šefčovič, stressing China’s rare earth controls as lawful enhancements to global stability and urging the Netherlands to uphold contracts. Šefčovič expressed understanding for China’s measures and offered EU mediation for a “swift solution.” Wang also discussed the issue with Dutch Economy Minister Vincent Karremans, demanding protection for Chinese investors. Karremans affirmed commitment to bilateral ties and constructive resolutions.

A Wake-Up Call for EU Autonomy

The Nexperia saga underscores Europe’s fragility in a fracturing world. The Wall Street Journal noted on October 15 that the events highlight US leverage in pulling allies into its orbit. Analysts urge EU unity and strategic rethinking. Gomes advocated handling such issues at the EU level for true independence, though he admitted constraints persist.

Van der Putten warned that Europe’s “balancing act” between the US and China is crumbling, with Washington forcing decisions aligned to its interests. “The situation is truly urgent—this isn’t a 15-year problem; it’s one we must solve in the coming years,” he emphasized, lest the continent tear further apart in the US-China rivalry.

As the EU and China seek a “pragmatic fix,” the incident serves as a stark reminder: in the chip wars, neutrality is a luxury Europe can no longer afford.

References

- South China Morning Post. (2025, October 27). Dutch analysts: Nexperia saga exposes Europe’s US-China bind.

- BBC News. (2025, October 13). Nexperia: Dutch government takes control of China-owned chip firm.

- Al Jazeera. (2025, October 14). Why has Dutch government taken control of China-owned chipmaker Nexperia?

- Reuters. (2025, October 13). In rare move, Dutch government takes control of China-owned chipmaker Nexperia.

- Bloomberg. (2025, October 14). Dutch Seized Nexperia After US Demanded Chinese CEO’s Exit.

- The Economist. (2025, October 16). The Dutch seize control of Nexperia from its Chinese owner.

- CNBC. (2025, October 13). Dutch government takes control of Chinese-owned chipmaker Nexperia in ‘highly exceptional’ move.

- CNN Business. (2025, October 13). Nexperia: Dutch government takes control of Chinese-owned chipmaker in rare move.

- CNN Business. (2025, October 15). How a Dutch chipmaker got caught up in the US-China tech war.

- Euronews. (2025, October 13). Netherlands invokes rare emergency law to take charge of Chinese chipmaker.

- AP News. (2025, October 13). Dutch government takes control of Chinese-owned chipmaker Nexperia over governance shortcomings.

- The Guardian. (2025, October 23). Battle between Netherlands and China over chipmaker could disrupt car factories, companies say.

- Bloomberg. (2025, October 14). China Puts Export Controls on Nexperia After Dutch Takeover.

- Bloomberg. (2025, October 13). China’s Wingtech Dives 10% After Dutch Take Control of Nexperia Chip Unit.

- POLITICO. (2025, October 13). Dutch government seizes control of Chinese-owned chipmaker Nexperia.

- Wikipedia. (2025, October 24). Nexperia.