On September 25, 2025, China’s Ministry of Commerce announced that Huntington Ingalls Industries (HII) had been placed on its export control list.

What looked like a technical trade notice was in fact a heavy blow to the U.S. Navy’s “heart.” HII is the only company capable of building and maintaining America’s nuclear-powered aircraft carriers—the backbone of U.S. maritime dominance. By cutting off supply, Beijing is not just targeting a corporation but striking at the central nervous system of U.S. military power.

The timing was even more symbolic: just three days after China’s Fujian carrier completed electromagnetic catapult tests, Beijing followed up with sanctions. The move was not only about technological confidence but also a strategic signal—China is reminding Washington that its strength lies not just in new carriers but in controlling critical industrial lifelines.

Hitting the U.S. Navy’s Steel Heart

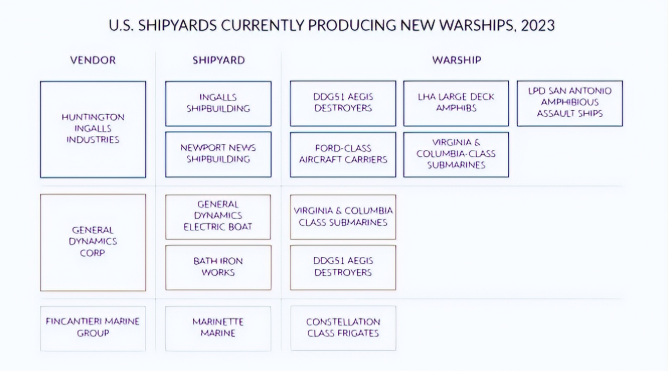

HII may not be a household name, but its Newport News Shipbuilding yard is America’s only facility for nuclear carriers. From the Nimitz class to the Ford class, every U.S. carrier depends on it.

In plain terms, if this yard stops for a single day, U.S. shipbuilding schedules collapse for weeks. Unlike broad punitive sanctions, China’s strike was a precise “pressure point” attack—choking the lifeline of U.S. carrier construction.

Already, the USS John F. Kennedy (CVN-79) has seen its delivery delayed from 2022 to 2027, and now potentially to 2030. The USS Enterprise (CVN-80) faces steel shortages, with inventories of 300 tons of specialized steel nearly exhausted. Newport News has even activated “emergency shutdown” plans.

A critical weak spot is the 70,000-ton floating dry dock that HII imported from China in 2019—vital for carrier overhauls. With China now halting parts and servicing, the dock is half-paralyzed, like an operating theater without electricity.

And HII is not alone: Saronic Technologies and two other firms tied to unmanned systems, satellite communications, and ocean engineering were also blacklisted. Together, the sanctions hit not just hardware but the command-and-control web of U.S. forces in the Asia-Pacific.

U.S. Defense Industry: Strong Front, Fragile Roots

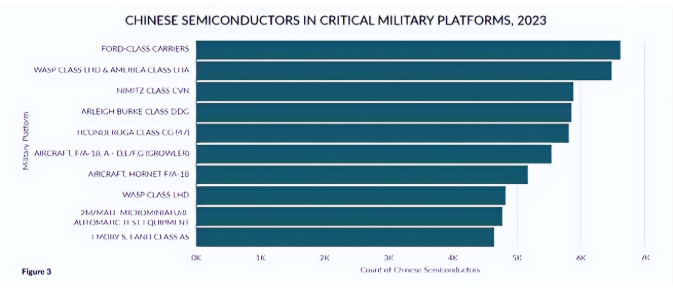

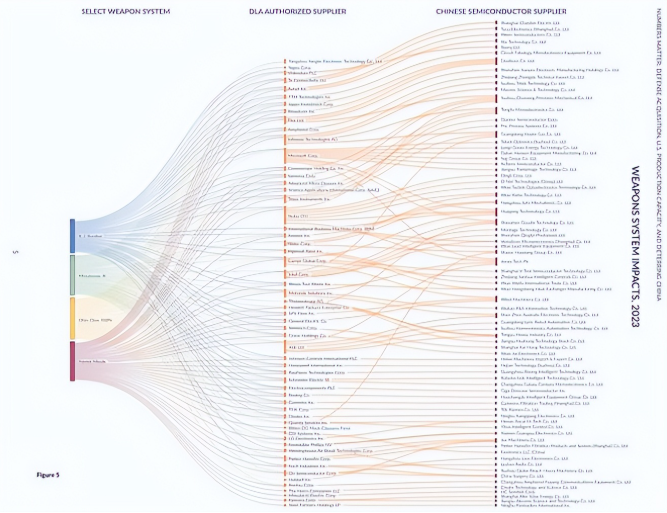

America’s defense sector looks formidable, but its Achilles’ heel lies in the supply chain. Building a single Ford-class carrier requires 12,000 tons of specialized steel, nearly one-third sourced from China.

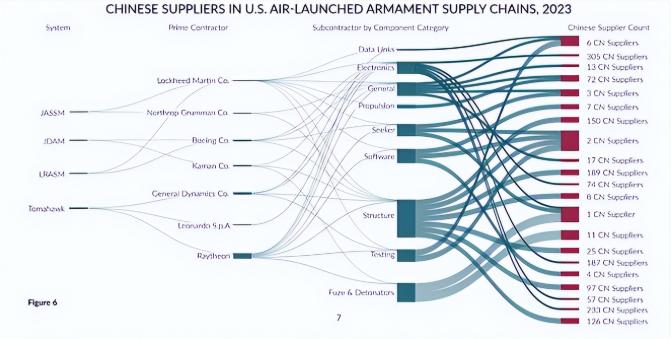

Key materials such as high-strength alloys, rare earths, and precision electronics are similarly dependent on Chinese supply.

For example:

- Arresting wires, critical for carrier landings, rely on alloys in which China dominates global production.

- NdFeB magnets, essential for radars, are 85% sourced from China.

In effect, the U.S. owns the hull, but the “heart and nerves” come from China.

This dependence runs deep: U.S. weapons systems involve 20,000 parts across 12,000 supply chains, with 87% of core links tied to China. A single broken link risks short-circuiting entire systems.

Substitution is not a quick fix. German suppliers estimate at least five years to replace some Chinese high-tech equipment. For the U.S. to rebuild its own supply chains, it must overcome challenges in capacity, cost, technology, and talent—none of which have been solved.

Ripple Effects: A Global Power Shift

Though framed as a bilateral clash, the ripple effects are global.

- Southeast Asia is recalibrating. Vietnam is pushing a “South China Sea Code of Conduct 2.0,” while Indonesia has invited China for joint patrols. Such moves signal regional states’ strategic tilt toward Beijing.

- In technical standards, momentum is shifting. China’s Type 004 carrier uses four electromagnetic catapults with a failure rate of just 0.1%, compared to the Ford-class’s 1.2%. Its carriers can operate the J-35 stealth jet and GJ-11 UAV simultaneously, demonstrating multi-platform compatibility where the U.S. struggles.

- On the industrial side, America’s “reshoring” dream is faltering. U.S. steel utilization has fallen from 80% to 65% despite political promises. HII alone consumes 35% of the Navy’s specialty steel orders—now jeopardized.

Markets have noticed. HII’s stock plunged 12% in a single day, wiping $20 billion from the defense sector. Investors sent a clear message: this is not a passing storm but a structural realignment.

Beyond Carriers: Supply Chains as the Real Battlefield

This is not tit-for-tat retaliation but a strategic restructuring of rules. China is no longer a rule taker, but increasingly a rule maker at the supply-chain level.

From raw materials to systems, Beijing is signaling: control the supply chain, and you control the discourse.

The era when Washington could weaponize sanctions with impunity is fading. Today, China has demonstrated its own leverage. For the U.S., this means more than shipyard delays—it forces a reckoning with whether its global naval dominance can persist without China’s industrial inputs.

Future Sino-American maritime competition will be more than clashes of fleets. It will be a three-dimensional contest across supply chains, technology ecosystems, and regulatory standards.

And in this asymmetric game, China is no longer the pursuer—it is increasingly the dealer at the table. While U.S. carriers wait for missing parts, China’s next-generation nuclear-powered carrier may already be nearing launch. This is not merely about one sanction—it signals a turning point in global sea power.