Recently, China announced new, stricter measures to control the export of rare earth materials, including those crucial for chip manufacturing. The new regulations, which not only target rare earth products but also restrict the export of rare earth refining technologies, have immediately caught the attention of global markets, particularly the U.S. This is a significant shift, as China’s rare earth exports will now be limited to certain end-users, and any product related to Chinese rare earth technology will also face restrictions.

The Impact on the U.S. Chip Strategy

This move comes at a time when the U.S. is aggressively pushing for the localization of its chip production. By announcing stringent export controls, China has directly impacted the U.S.’s semiconductor strategy. Given that the U.S. relies heavily on Chinese rare earth materials for chip production, this new policy means that any chip-related products made using Chinese rare earths will fall under strict regulation. This is a clear challenge to the U.S.’s semiconductor ambitions.

China’s Countermeasure: “Using Magic to Defeat Magic”

For years, the U.S. has used its so-called “long-arm jurisdiction” to contain China. Now, China has turned the tables, applying a strategy similar to the U.S.’s sanctions model. China has a near-monopoly on the rare earth refining industry and controls the entire supply chain. Since rare earth materials have both civilian and military uses, China, from a national interest perspective, is fully justified in tightening its export controls.

Rare earths are critical to numerous high-tech industries, and China, with its expertise in refining, has effectively turned this sector into a powerful tool for geopolitical leverage. As the dominant player in rare earths, China can now use its position to counter Western sanctions, establishing rare earths as a strategic countermeasure to the West.

The Strategic Importance of Rare Earths

Rare earth materials are indispensable for many high-tech applications, including defense technology. For example, the U.S. F-35 fighter jet, developed by Lockheed Martin, requires 400 kilograms of rare earth materials for its construction. Similarly, U.S. Navy ships, such as the Aegis missile destroyers and nuclear submarines, also depend on rare earth materials. Given the critical role of rare earths, the U.S. President’s reaction to China’s export restrictions was telling. He claimed that China’s decision to impose these controls without prior notice exposed America’s vulnerability and the soft underbelly of its military-industrial complex.

The EU’s Growing Concern

China’s tightening control over rare earth exports has not only triggered alarm in the U.S. but also caught the attention of the European Union. The EU Commission quickly expressed its concerns, urging China to be a reliable partner and to ensure the stable supply of critical raw materials. This is ironic, given that the West, in imposing sanctions on China, has never considered China a “reliable partner.” Instead, Western countries have sought to restrict China’s access to critical technologies, such as semiconductor lithography machines and high-end chip-manufacturing technologies.

The Ripple Effect on Western Tech Companies

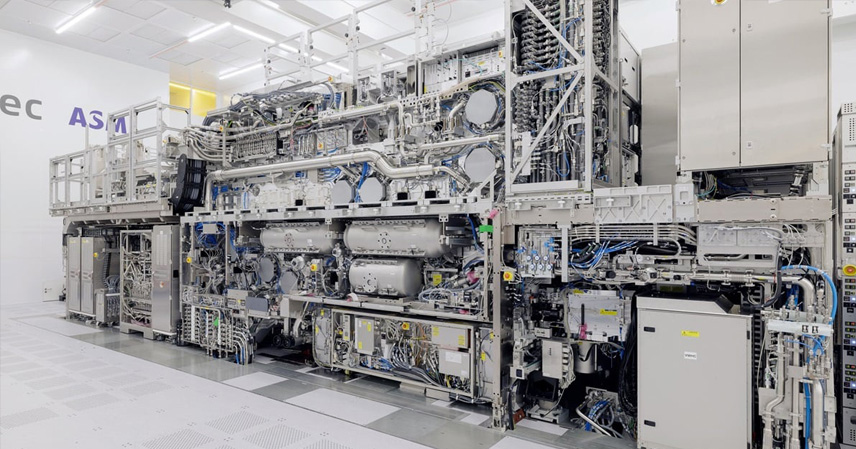

As China tightens its grip on rare earth exports, the Western tech industry is beginning to feel the pressure. According to U.S. media reports, a major Dutch lithography machine maker has announced delays in the delivery of its products. This is due to the fact that the Dutch-made lithography machines require rare earth materials from China. Since the Netherlands must now obtain Chinese approval to export these machines, it faces the possibility of delays in production and delivery.

This situation reflects the broader issue: if Western countries ignore China’s export controls, they may face significant setbacks. The West is now experiencing the consequences of its earlier actions, and the balance of power in high-tech industries is starting to shift.

References

- Chinese Government Announcement on Rare Earth Export Controls, October 2025

- U.S. Media Reports on Rare Earths and Semiconductor Impact

- EU Commission’s Response to China’s Export Restrictions

- Reports on Dutch Lithography Machine Delays