When China announced export controls on rare earths, many thought it was the ultimate countermeasure in the U.S.-China tech confrontation. But the real shock came later — Beijing’s decision to impose restrictions on synthetic diamond materials, a move that strikes at the very heart of U.S. manufacturing.

From Chip Sanctions to Material Warfare

Since 2018, the United States has intensified its campaign against China’s tech rise — from chip bans on Huawei and ZTE to global pressure on allies like Japan and the Netherlands to restrict the export of lithography machines and AI hardware. By 2023, Washington had extended its sanctions to semiconductor materials, tightening the noose on China’s tech ecosystem.

China, however, chose not to respond rashly. Instead, it tested the waters with rare earth export controls in mid-2023, requiring special permits for key equipment and technology. By 2024, the restrictions expanded to the refining stage, prompting the U.S. to scramble for alternatives through Australia, Vietnam, and Myanmar.

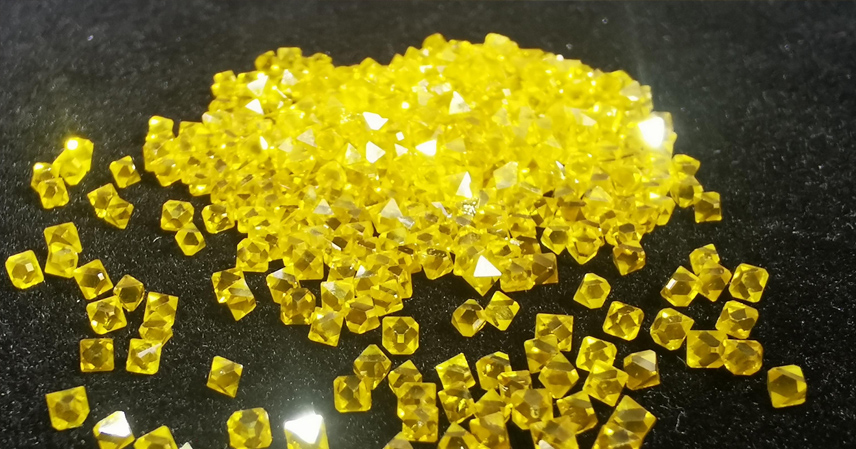

Then came the real blow. On October 9, 2025, China’s Ministry of Commerce and General Administration of Customs announced that, starting November 8, exports of six categories of superhard materials would require licenses — including diamond micropowder, monocrystals, diamond wire saws, and even the related synthesis equipment and technology.

A Precision Strike on America’s Weak Spot

While jewelry-grade lab-grown diamonds are exempt, the ban hits industrial-grade synthetic diamonds, a sector that underpins high-tech manufacturing. Synthetic diamonds are 30 times harder than steel, outperform copper in heat conductivity and corrosion resistance. They’re indispensable in semiconductor wafer cutting, aerospace parts machining, and quantum computing components.

And here’s the kicker — over 90% of the world’s high-purity diamond micropowder comes from Henan Province, China. The country dominates every step of the supply chain, from high-pressure synthesis to precision processing.

Unlike rare earths, which have alternative global sources, synthetic diamond production is highly concentrated and technically complex. The U.S., once a pioneer through companies like GE and 3M, now relies heavily on Chinese imports. Rebuilding a domestic supply chain could take years and billions in investment.

Industrial Shockwaves

The impact was immediate. Synthetic diamonds are critical for Apple’s chip production, NVIDIA’s GPU manufacturing, and even U.S. military projects like the F-35 fighter jet. A sudden disruption could cut semiconductor efficiency by 30%.

China currently supplies around 85% of the global synthetic diamond market, with U.S. imports exceeding $1 billion annually. Under the new rule, every shipment requires approval — giving Beijing powerful leverage over Washington.

Behind this move lies China’s broader strategy: “You sanction my technology, I control your materials.”

Strategic Retaliation, Not Revenge

Beijing’s decision reflects a calculated escalation rather than a knee-jerk reaction. After the U.S. expanded its chip ban in 2024 — even targeting cloud computing services — China bided its time. First came export controls on gallium and germanium, which sent shockwaves through global markets. The synthetic diamond measure goes further, restricting not only exports but also technology transfer, closing the door on reverse engineering.

Washington’s anxiety is palpable. The Pentagon reportedly invested $500 million in 2024 to build domestic diamond facilities, but progress has been slow. China’s CVD (chemical vapor deposition) technology is cheaper and more advanced, giving it an insurmountable lead.

As news of the control broke, U.S. tech stocks tumbled — Intel and AMD both fell over 5%. Analysts warned of rising global electronics prices, predicting that consumers would pay more for smartphones and computers.

The U.S. Vice President’s office issued a muted response, stating it would “assess the situation,” while quietly reaching out to allies to diversify supply chains. Japan, South Korea, and Taiwan — all reliant on Chinese diamond tools — began stockpiling inventories.

Domestic Impact and Global Realignment

For Chinese manufacturers like Henan Huanghe Whirlwind and Power Diamond, the export curbs brought short-term volatility but long-term opportunity. With the domestic market booming — from 5G base stations to EV battery components — these companies are pivoting toward internal demand and new applications.

Experts view the measure as a milestone in the global industrial realignment. China’s 14th Five-Year Plan had already emphasized superhard material self-sufficiency. Now, the policy has evolved into a strategic deterrent — a clear signal that Beijing can and will respond to technological containment.

Short-term, the U.S. may seek alternatives from India or Vietnam, but quality gaps remain huge. In the long run, rebuilding capacity could take at least five years.

Historically, America led in innovation but lagged in manufacturing resilience. Now, China’s material dominance is redrawing the global tech map.

Looking Ahead

The export control may raise global prices, but it strengthens China’s industrial base and protects its strategic interests. For ordinary consumers, the cost is minor compared to the broader benefit of technological self-reliance.

In Washington, the tone has already shifted. U.S. Senator J.D. Vance recently called for “dialogue over confrontation,” signaling a growing realization that material interdependence leaves no easy escape.

Future negotiations may see a mutual easing — chips for materials — but one thing is clear: China now holds a card powerful enough to demand respect at the global table.

References

- People’s Daily: Ministry of Commerce and Customs Announce Export Control on Superhard Materials

- Ministry of Commerce of the People’s Republic of China – Official Notice (Oct. 9, 2025)

- Bloomberg, Reuters, Global Times trade data analysis