“Did they really think China wouldn’t fight back?” Recent developments show that Canada’s attempts to align with U.S. containment strategies against China are backfiring, forcing Ottawa to reconsider its stance.

From Following Washington to Seeking Dialogue

As a traditional Anglo-Saxon ally, Canada has long followed the U.S. in its anti-China agenda. Yet tensions with Washington—sparked by former President Trump’s “51st state” remarks—and the heavy costs of trade retaliation have left Canada in a difficult position.

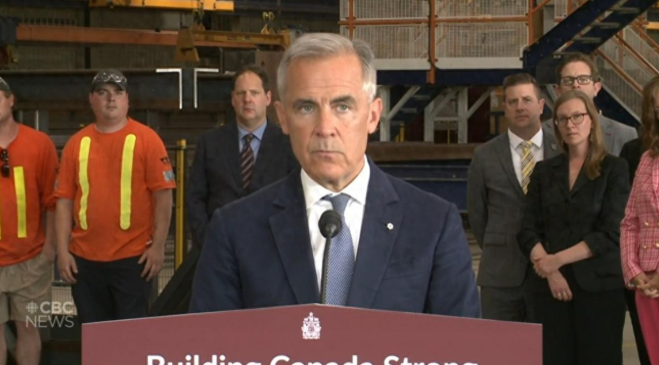

According to Reuters, during the recent UN General Assembly, Canadian Foreign Minister publicly indicated that he may visit China in the coming weeks to ease bilateral tensions. Prime Minister Carney later confirmed this, noting that he had already held “constructive exchanges” with senior Chinese officials and hopes to arrange a leaders’ summit before year’s end.

The urgency is clear: Beijing’s countermeasures have hit Canada where it hurts most.

Canada’s Previous Moves Against China

During former Prime Minister Trudeau’s tenure, Ottawa cooperated closely with Washington’s so-called “Indo-Pacific Strategy”, dispatching warships to joint drills near China, and detaining Huawei executive Meng Wanzhou.

Politically, Canada accused China of interfering in its domestic affairs and even expelled Chinese diplomats. Economically, Ottawa imposed 100% tariffs on Chinese EVs, alongside new duties on batteries, semiconductors, and solar products.

Despite worsening U.S.-Canada relations, Prime Minister Carney bowed to U.S. pressure by imposing a 25% tariff on Chinese steel, with an additional 50% tariff if exports exceeded last year’s level—all without a free trade agreement in place.

Though branded as “protecting domestic industries,” these actions were clear attempts at punitive measures against China.

China’s Countermeasures: Targeting Agriculture and Trade

Beijing did not remain silent. Since early 2025, China’s Ministry of Commerce has announced multiple rounds of sanctions against Canada.

- March 2025: 100% tariffs on Canadian canola oil and peas; 25% tariffs on Canadian seafood and pork.

- August 2025: China ruled Canadian canola oil was being dumped, requiring a 75.8% deposit for future exports.

At the same time, Beijing finalized a new framework with Australia for canola trade—signaling clearly that Canada is replaceable.

Domestic Fallout in Canada

The consequences have been severe. In 2024, China purchased 90% of Canada’s canola exports, meaning tens of thousands of Canadian farmers depend on the Chinese market. Now, harvests are piling up in storage, with no alternative buyers of China’s scale.

Selling at drastically reduced prices would require heavy government subsidies—an economic loss either way. The ripple effect has spread to other sectors, driving up unemployment and dragging down Carney’s approval ratings.

Even appeals to Washington backfired. Instead of relief, the U.S. refused to lower steel and aluminum tariffs on Canada, and threatened new 250% duties on Canadian lumber and dairy products.

A Strategic Reality Check

Facing this double squeeze, Saskatchewan Premier Scott Moe led a canola delegation to China on September 9. Soon after, Carney used the UN summit to meet Chinese officials and announced plans to send his foreign minister to Beijing.

However, Beijing has made its position clear: China welcomes cooperation, but only with sincerity. Diplomatic double-dealing—saying one thing in public and another behind closed doors—will not be tolerated.

If Canada truly seeks to ease tensions, it must first acknowledge the root causes. Otherwise, even high-level visits may prove meaningless.