Recently, there was a lot of noise over Nvidia’s refusal to supply high-end products to the Chinese market, causing a stir. In the meantime, “China’s alternative to Nvidia,” Cambrian, quickly rose to the top of trending topics. People began paying more attention to Cambrian’s chips.

This led to a massive surge in Cambrian’s stock price, surpassing Moutai to become the largest stock in the country. Just when everyone was optimistic about Cambrian’s future, an unexpected event occurred. On September 4th, Cambrian’s market value plummeted by over 12% in one day, losing 70 billion yuan!

From August 28th’s peak to now, Cambrian has lost more than 160 billion yuan in just six trading days, which is shocking. The roller-coaster-like rise and fall of Cambrian’s stock has been an emotional ride for its investors. What exactly happened?

Cambrian’s Success Story

Cambrian’s success can be attributed to the scarcity of chips. Huawei’s chips are still not available, and in the A-share market, only companies like Haiguang and Cambrian are considered industry leaders.

Why is Cambrian referred to as the “alternative to Nvidia”? It’s because Cambrian’s latest 590 chip is 80% similar in performance to Nvidia’s H100, which is why people refer to it as “the alternative to Nvidia.”

Furthermore, Cambrian’s resilience, despite being added to the US Entity List, has made it a rare success in the semiconductor industry, one of the most challenging sectors in recent years. Cambrian has not only survived but has also created AI chips and implemented them commercially, making its mark in the future AI chip competition.

From 2017 to 2024, Cambrian’s R&D expenses have consistently exceeded its operating revenue. Despite operating at a loss, Cambrian invested a whopping 2.875 billion yuan in chip development.

When the US announced its plans to suppress China’s AI chip development, it only strengthened China’s resolve to innovate. The more the US suppresses, the more determined China becomes to create opportunities for innovation.

Chinese investors have strongly supported Cambrian. On August 28th, Cambrian’s stock price surged beyond Moutai, becoming the leading stock in China.

When Cambrian first listed in 2020, there were only 23,000 retail investors; today, that number has only grown to 40,000. However, Cambrian’s institutional investment has skyrocketed from 3 funds to 97, and then to 562.

Cambrian’s stock price was initially high, reaching 64.39 yuan per share. On August 28th, it peaked at 1,595.88 yuan per share, with most of the purchases coming from institutions, and retail investors being in the minority.

This suggests that once Cambrian’s stock price increases, it has a strong trend, but the risks are also significant. Once institutional investors form a group and funding becomes insufficient, a major crash can occur.

Deviating from Basic Logic

After Cambrian became known as the “alternative to Nvidia” in the chip industry, its market value surged. But when looking at the current competitive landscape, there is still a huge gap between Cambrian and Nvidia—one is the world’s chip king, and the other is a rising domestic company.

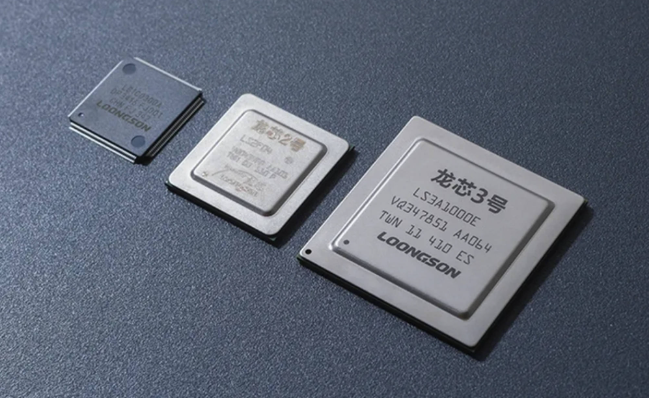

Cambrian may have exploded in popularity, but there are other dominant players in the domestic chip market, such as Huawei’s Ascend and Haiguang Information, which are known for their top-tier domestic technologies.

Therefore, Cambrian needs to surpass these companies before it can compete shoulder-to-shoulder with Nvidia. Cambrian’s massive surge in market value has already deviated from the basic logic of stock trading, making it highly uncertain, with the possibility of a drastic decline at any time.

However, Cambrian is not the only company working on products similar to Nvidia’s. Huawei’s Ascend 910 series has already entered mass production, and this chip is also widely regarded as the closest match to Nvidia’s H100.

Another strong competitor, Haiguang, has developed its flagship product, ShenSuan 3, which is considered on par with Nvidia’s H100.

Haiguang’s chip has an advantage in its ecosystem, as well as domestic backing, with 90% of government software relying on it. This saves significant effort in subsequent research and development.

Moreover, Haiguang’s R&D expenses have reached 6.4 billion yuan over the past two years, compared to Cambrian’s 2.875 billion yuan. In terms of R&D funding, Haiguang is undoubtedly closer to Nvidia.

With other companies offering products that are similar or even better, consumers are less likely to choose Cambrian’s chips that offer only 80% of the performance.

In addition, more domestic chip companies are emerging, with four companies preparing for IPOs. Once these four companies are listed, Cambrian will face increasing competition.

One of these emerging “dark horses” is Mozi Thread, which has shown exceptional growth. In 2024, it generated 438 million yuan in revenue, a 208.44% increase compared to last year.

If Mozi Thread continues to grow at this rate, it is only a matter of time before it surpasses Cambrian. Although there are many chip companies in China, China’s position in the global chip market is still relatively passive.

The Battle for Chips

Whoever masters AI chip technology will have a better chance of development. The US is using its current equipment and technology to hinder China’s progress, involving countries like Japan and South Korea in its efforts to suppress China’s chip development.

The US has a dominant position in the chip industry and aims to monopolize the global chip supply chain, limiting China’s scientific research institutions and suppressing China’s electronic engineering development.

However, China also possesses rare earth materials that the US needs. To develop other fields, the US relies heavily on China’s resources. Since the US has taken the first step, China will not remain passive and will inevitably create better chips.

However, Cambrian’s rapid stock price drop is concerning. In just six days, it evaporated 160 billion yuan. Investors’ emotions have been as turbulent as a roller coaster. Cambrian must increase its investment in R&D and develop flagship products to survive in this battle.

China now has more and more emerging chip companies, and they are developing rapidly. We believe China’s chip industry will eventually stand on the global stage and benefit more consumers.