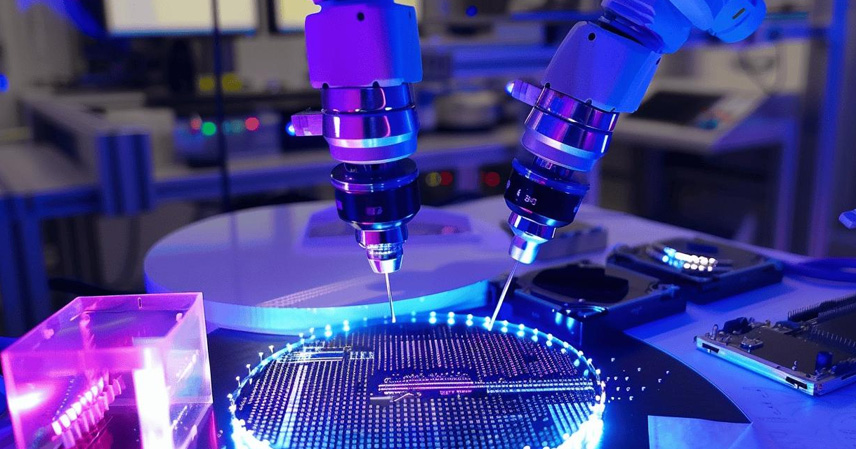

28nm Chips Become China’s Strategic Advantage

Japanese media recently reported that 70% of global orders for mature semiconductor processes are now being directed to Chinese factories, with prices so low that industry insiders are reportedly stunned.

While the U.S. treats EUV lithography machines as its strategic “nuclear option” to block China from high-end chip manufacturing, China has effectively carved a path using 28nm mature process technology, proving that you don’t need the most advanced nodes to dominate a significant segment of the market.

U.S. “High-End” Strategy Faces a Counterattack

The U.S. assumed that controlling EUV machines, crucial for advanced chips, would cripple China’s semiconductor industry. Yet China avoided high-end confrontations and focused on 28nm chips, widely used in automotive electronics, IoT devices, and home appliances.

By securing this mature node, China captured a large market share, taking the U.S. and Japan by surprise. This success highlights a key lesson: as long as talent is retained, China can innovate and compete globally.

The Talent and R&D Gap

Historically, China’s semiconductor industry suffered from a talent and strategy gap. Many companies adopted a mindset of “buying is cheaper than making”, relying heavily on imported technology rather than investing in in-house R&D.

For example, Lenovo’s early chip initiatives under the Chinese Academy of Sciences had solid research foundations. However, as the company transitioned from a state-owned enterprise to a private entity, the focus shifted to assembly and outsourcing, sidelining innovation and core technology development. Many engineers were forced out or had to abandon research directions, leaving China vulnerable to foreign supply restrictions.

Lessons for the Future

China’s recent success in 28nm mature processes underscores the importance of talent retention and strategic focus on core capabilities. Even without access to the most cutting-edge EUV equipment, China can dominate essential market segments by leveraging its skilled workforce and strategic industrial planning.

This story also serves as a warning: relying solely on high-end restrictions to control global technology supply chains is insufficient. Innovation and talent cultivation remain the ultimate competitive edge.

References

- Japanese media reports on global mature process chip orders, 2025

- Historical data on Lenovo and Chinese Academy of Sciences semiconductor projects

- Industry analysis on 28nm chip demand in automotive and IoT sectors