October has once again turned the U.S.–China trade relationship into a high-altitude free fall.

China has just unveiled a “precision-guided” export control list targeting rare earth materials, and within hours, Donald Trump fired back, threatening a ban on Boeing parts exports to China and proposing a 100% punitive tariff on Chinese goods.

Markets reacted instantly. Boeing executives, one might imagine, had only one question left:

“Do you want me to die fast, or faster?”

But could Trump’s new move really hurt China? Maybe not—because Boeing might collapse first.

China’s Rare Earth Move Hits America’s Tech Heart

On October 9, China’s Ministry of Commerce and Customs Administration jointly announced new regulations imposing comprehensive controls on rare earth exports—materials that may look ordinary but carry geopolitical power comparable to a nuclear trigger.

Two key clauses make this round of regulation particularly potent—and tailor-made for Washington.

1. The “traceability” rule:

Any product containing over 0.1% of Chinese rare earths now requires export approval.

This means a car assembled in Germany or a washing machine made in South Korea could be affected if it uses Chinese rare earth materials.

Beijing has effectively extended its influence from the mining pits to the global tech supply chain’s final assembly lines.

2. The semiconductor clause:

Any equipment used to manufacture chips below 14 nm or memory above 256 layers must undergo case-by-case review if it involves Chinese rare earths.

That includes Dutch lithography machines or U.S. etching tools—if Chinese materials are in play, Beijing must approve.

This is not a minor trade restriction; it’s China’s first direct surgical strike on the nervous system of the global semiconductor ecosystem.

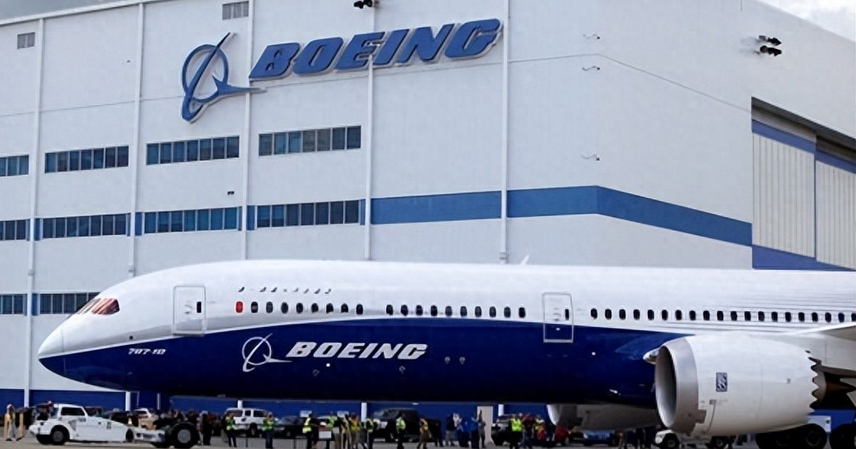

Trump’s “Boeing Ban”: Who Really Gets Hurt?

In response, Trump rushed out on October 10, threatening to ban Boeing parts exports to China and impose 100% tariffs on Chinese goods.

At first glance, it sounds like a bold counterpunch. In reality, it’s closer to economic self-sabotage.

Trump’s calculation seems simple:

“If China can choke off chip materials, we’ll choke off their aircraft.”

After all, China has purchased thousands of Boeing jets that depend on U.S. spare parts and maintenance. Cut the supply, ground the planes—problem solved.

Except, Boeing might not survive the “solution.”

As of mid-2025, Boeing was already struggling with delivery delays and evaporating orders.

While China only accounts for 8–15% of Boeing’s global revenue, it remains the largest and fastest-growing overseas market.

A ban wouldn’t just mean losing a customer—it would mean losing an entire continent of demand.

Meanwhile, China is not defenseless.

Its airlines have developed the ability to perform A-, C-, and even partial D-level inspections domestically.

Existing spare parts stockpiles could last 3–6 months, and there are three alternative strategies ready:

- Third-party procurement through neutral countries.

- Sourcing from alternative component manufacturers.

- “Self-recycling”—harvesting parts from decommissioned aircraft.

Russia has already used this model to keep its Sukhoi fleet flying under sanctions.

China’s industrial depth and market scale make such adaptations even more feasible.

The short-term turbulence could, paradoxically, accelerate the rise of the domestic C919 aircraft and push Boeing further toward the edge.

Beyond Trade: A Battle for Global Supply Chain Power

This isn’t merely an exchange of “rare earths for airplanes.”

It’s a direct clash over who controls the world’s industrial lifelines.

China holds the source power—resources and manufacturing.

The U.S. holds the system power—technology standards and global rules.

But in today’s interconnected economy, what the world truly values is stability, not threats.

China’s latest export rules are not impulsive; they’re systematic, data-driven, and strategically calibrated.

From traceability audits to end-use checks, Beijing is now setting the rules, not merely reacting to them.

The U.S., on the other hand, appears increasingly reactive.

Trump’s “Boeing ban” feels less like a policy and more like a political performance—a way to project toughness ahead of elections, even if it risks domestic blowback.

China’s Long Game: From C919 to C929

While Washington postures, Beijing is building.

China’s C919 has already entered commercial service, and the C929 wide-body jet is in active planning.

If Boeing’s parts ban becomes reality, it would only accelerate China’s shift toward self-reliance in aviation.

What was meant to be a “chokehold” could end up becoming a catalyst for independence.

Conclusion

From rare earths to aircraft, the U.S.–China confrontation has evolved beyond rhetoric.

The real contest is not about who shouts louder—but about who can maintain control of the market and the supply chain.

In that race, Boeing’s fate may no longer rest in China’s hands—

it may have already been pushed off the cliff by Trump himself.

If Washington truly goes through with the export ban, for Boeing, it won’t just be dangerous—

it will be fatal.

References

- Ministry of Commerce of the People’s Republic of China, October 2025

- Reuters, Financial Times, Bloomberg (analysis reports, 2025 Q4)