On October 8, Indonesian Investment Minister Rosan Roeslani publicly stated that Indonesia’s high-speed rail operator, PT Kereta Cepat Indonesia China (KCIC), is facing imminent debt obligations and hopes to negotiate debt restructuring with China to avoid default. This announcement has drawn significant international attention.

Project Background

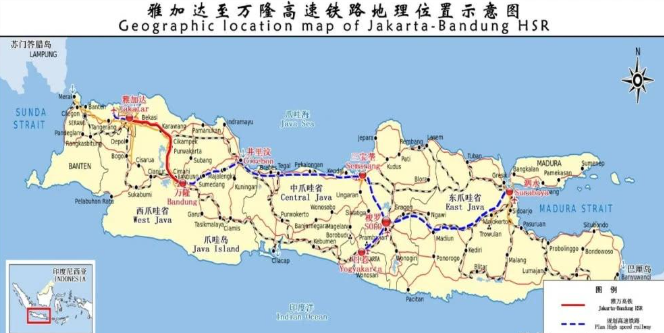

The Jakarta–Bandung High-Speed Rail (Jakarta-Bandung HSR), completed in 2023, had a total cost of approximately $7.3 billion. Of this:

- $4.55 billion was borrowed from China in 2017 at 2% annual interest over 40 years.

- Due to COVID-19 restrictions and land acquisition delays, additional costs rose by $1.2 billion, of which $560 million was financed through Chinese loans at 3.4% annual interest.

In total, Indonesia still owes tens of billions of dollars to China, creating significant repayment pressure.

Financial Challenges

Even with debt restructuring, repayment remains difficult. According to KCIC’s recent financial reports:

- 2024: $250 million loss

- First half of 2025: $96 million loss

Although revenue is slowly increasing, the company is expected to remain in deficit for some time, affecting its debt servicing capacity.

Root Causes: Domestic Factors

The need for debt restructuring is largely due to domestic issues rather than the Chinese loans themselves.

- The HSR currently carries an average daily ridership of 24,000, slightly below the planned 29,000.

- Ticket sales and auxiliary income could theoretically cover debt repayment under the original plan.

However, the Indonesian government, both central and local, has not developed complementary infrastructure as planned—such as:

- Commercial complexes

- Transport hubs

- Real estate projects

- Industrial parks

Effectively, Indonesia received the “fishing rod” (the HSR) but did not fish, limiting potential revenue growth.

Infrastructure Economics

High-speed rail is inherently capital-intensive and slow to yield returns. Beyond ticket sales, profitability often depends on ancillary industries along the rail corridor, including commercial development, real estate, transport, and industrial clusters.

For Indonesia, the HSR provides a foundation for economic development, but maximizing its value depends on domestic effort and efficiency. Attempting to reduce debt by simply renegotiating terms does not address the underlying problem.

Conclusion

China has delivered the high-speed rail infrastructure, but its full economic potential depends on Indonesia’s implementation of complementary development and efficient management. Debt restructuring may offer temporary relief, but long-term sustainability requires strategic domestic planning and maximizing the HSR’s value.

Sources:

- Lianhe Zaobao (Singapore), Oct 8, 2025

- Public financial reports of KCIC

- Project completion and investment data, 2017–2023