At Berlin’s Charlottenburg-Wilmersdorf Digital City, sunlight filters through the glass façade and glints off the display of the Xiaomi 14T Pro. A German youth, Lukas, scrolls through the phone’s 12GB + 512GB specs and scoffs: “The Samsung S24 FE sells for €699 and only has 8GB of RAM? It’s 2025 — does Samsung think it’s an iPhone?”

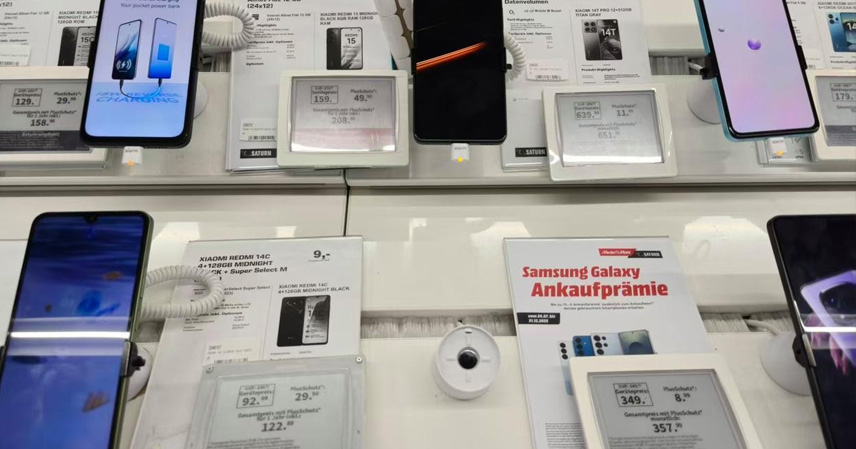

That single complaint captures a larger shift. As Xiaomi, OPPO, and Lenovo logos light up prime retail space from Berlin to Madrid, and as Chinese brands now make up over half of carrier contract plans, one fact is becoming undeniable: Chinese smartphones are reshaping Europe’s second-largest mobile market through “specification revolutions” and deep channel integration.

1. From “Value for Money” to “Spec Overkill” — The Power Shift in Hardware

In China, 12GB RAM has become the standard even for mid-range phones under ¥2,000. Yet in Europe, Samsung still sells 8GB phones for over €600, like the S24 FE that Lukas mocked. This “legacy arrogance” has created a gap that Chinese brands are quick to exploit.

The Xiaomi 14T Pro, priced at €499, comes with a Dimensity 9300+ chip and 12GB+512GB storage. OPPO’s Find X8 offers a custom imaging chip and 2K display for €699, while realme’s GT5 Pro brings 150W fast charging to a market where Samsung still caps at 45W.

“Europeans are far more spec-sensitive than people think,” says a Chinese store owner in Berlin. “12GB versus 8GB, 150W versus 45W — those numbers are the marketing.”

According to Counterpoint, Xiaomi’s market share in Western Europe’s mid-range segment hit 28% in Q2 2025, up 11 points year-over-year, while Samsung dropped to 35%.

2. Carrier Channels — From “Passive Entry” to “Strategic Alliance”

Roughly 70% of European smartphone sales come through carrier contracts, historically dominated by Samsung and Apple. Chinese brands were once marginalized due to weak partnerships and tariffs. That’s no longer the case.

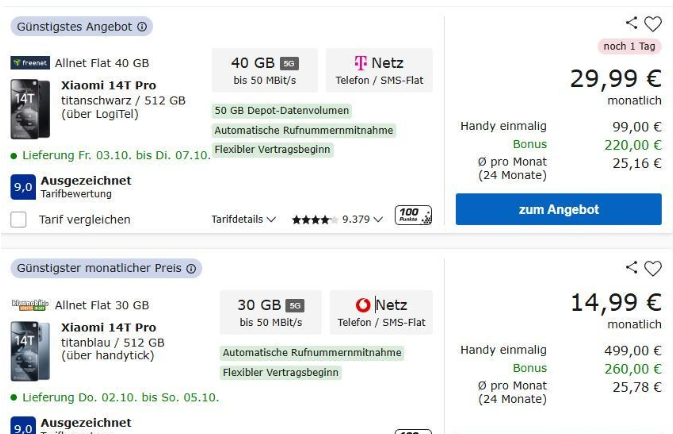

- Xiaomi and Vodafone now offer a “switch bonus” of €260 — customers can get a 14T Pro for just €99 upfront with a two-year plan (€29.99/month, 40GB data).

- OPPO and Telefónica formed a “strategic alliance,” placing Find X8 on core in-store displays.

- realme partnered with Orange to push its C-series into prepaid bundles.

“Operators want affordable, high-quality phones; Chinese brands need channels — it’s mutually beneficial,” explains telecom analyst Li Jin.

By mid-2025, four of the top ten contract phones in Europe were from Chinese brands, up from just one in 2023.

3. Localization — From “Selling Products” to “Understanding Users”

Success in Europe isn’t just about hardware. Chinese brands are mastering local operations and compliance.

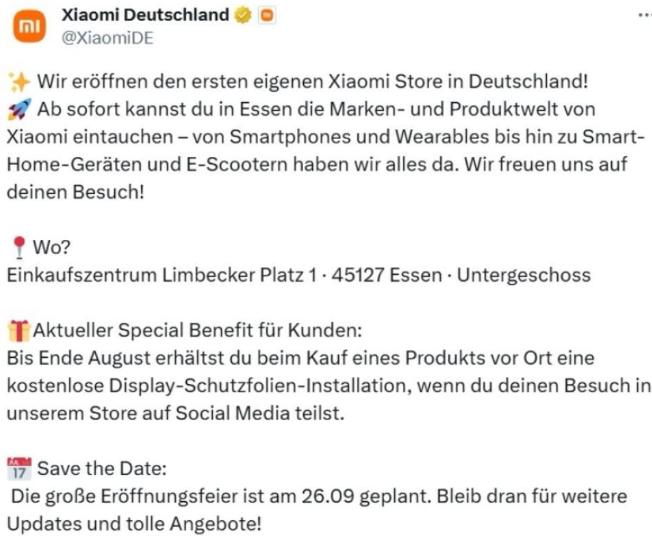

At a Xiaomi store in Berlin, staff confidently explain MIUI’s GDPR-compliant privacy mode in fluent German. In France, OPPO launched a trade-in program, offering up to €200 for old Samsung models. realme went viral on TikTok with a “150W fast-charging challenge,” using its phone to jump-start an electric car — earning over 5 million views.

Pricing strategy also plays a key role:

- Xiaomi’s flagship 15 series (€949) competes with the iPhone, while its 14T line (€499) targets Samsung’s A-series.

- OPPO’s Find X8 (€699) rivals Samsung’s S24 FE, while its Reno line drops to €300.

This multi-tiered pricing traps Samsung between Apple’s dominance at the top and Chinese aggressiveness below.

4. Samsung’s Struggle — Losing Ground to “Tech Intensity”

Samsung is fighting back. In August 2025, it upgraded the S24 FE to 12GB RAM, but kept the €699 price — still €200 more than Xiaomi’s equivalent.

“The issue isn’t innovation; it’s cost control,” notes a supply-chain insider. “Xiaomi gets the same Dimensity 9300+ chips at 8% lower cost because of higher volume and faster payments.”

Samsung’s problems go deeper. In foldables, Chinese models like the Motorola Razr 40 have dropped below €800, while Samsung’s Z Flip5 still costs €1,199. In camera performance, partnerships like Xiaomi–Leica and OPPO–Hasselblad have overtaken Samsung’s once-vaunted “108MP” bragging rights.

“Samsung is the new Nokia — comfortable, complacent, and suddenly outpaced,” Li Jin comments. “The European market’s ‘Big Three’ are now Samsung, Apple, and the Chinese alliance — and only one of them is truly growing.”

5. Beyond Market Share — Toward Global Influence

When Lukas finally walks out with his €39 Xiaomi 14T Pro on contract, he’s doing more than getting a bargain — he’s part of a global industrial shift.

China’s smartphone rise in Europe is not just about sales. It proves that in a standardized tech field, Chinese brands can win through supply chain integration, consumer insight, and local adaptation. From Xiaomi’s 100 flagship stores to OPPO’s carrier alliances and realme’s influencer campaigns, these models are now being exported globally — to India, Southeast Asia, and beyond.

Challenges remain: EU digital compliance, geopolitical risks, and Apple’s high-end dominance still loom large. Yet as Lukas said:

“12GB is better than 8GB. 150W charges faster than 45W. You can’t fake that.”

Soon, when European consumers think of ‘value smartphones,’ their first thought may no longer be Samsung — but Xiaomi and OPPO. And that shift means more than market share; it means China has begun to shape the conversation.

References:

- Counterpoint Research (2025 Q2 Europe Smartphone Market Report)

- Check24 Mobile Contract Rankings, 2025

- Reuters and Bloomberg Technology Coverage on Xiaomi & OPPO Europe Expansion