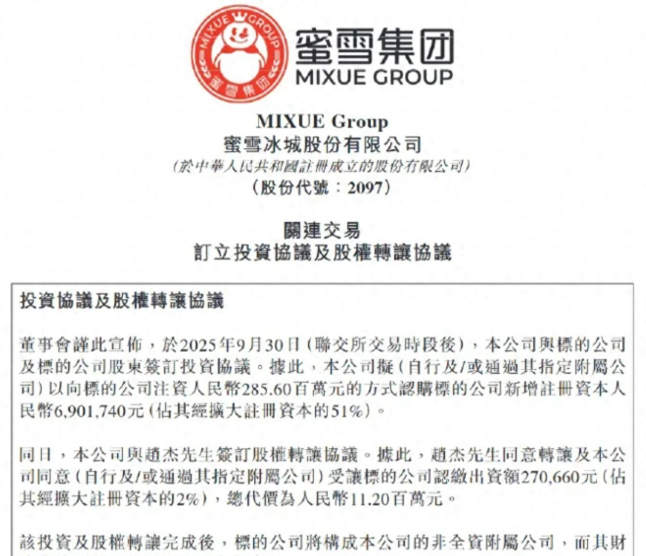

On October 1, 2025, Mixue Ice Cream & Tea announced a strategic acquisition of 53% equity in Xian Pi Fu Lu Jia (Fresh Beer Fu Lu Jia) for approximately 2.97 billion RMB (about $420 million USD), marking the tea giant’s bold entry into the fresh beer market. Post-deal, Fu Lu Jia will operate as a non-wholly owned subsidiary, with its financials consolidated into Mixue Group’s reports—expanding the “Snow King” empire from affordable teas, coffees, and ice creams to the mildly intoxicating world of draft beer.

The transaction’s standout feature is its related-party nature: Fu Lu Jia’s controlling shareholder, Tian Haixia, is the spouse of Mixue CEO Zhang Hongfu. While both entities have maintained independence in prior statements, this move unveils deeper strategic alignment, blending family ties with business synergy.

Fu Lu Jia specializes in 500ml fresh draft beers priced at 6-10 RMB, achieving profitability in 2024 with a net income of 1.07 million RMB. Its 1,200 franchise outlets span 28 provinces, mirroring Mixue’s “high-quality, low-price” ethos that has dominated lower-tier markets with hits like the 4 RMB lemon water.

At the heart of Mixue’s edge lies its formidable supply chain: A global network of 53,000 stores, 12-hour deliveries to 90% of county-level areas, and in-house production bases that slash costs. This infrastructure could upend fresh beer pricing, traditionally higher due to craft complexities.

Industry observers suggest Mixue may transplant its “ultimate value” model from lemon water to beer, leveraging bulk procurement for barley and hops while retrofitting tea outlets with beer chillers for seamless channel reuse. Fu Lu Jia’s innovations—like fruit-infused and tea beers—already hint at synergies with Mixue’s ingredient ecosystem.

Yet, this cross-category expansion carries risks. Craft beer thrives on unique flavors and premium branding, clashing with Mixue’s mass-market affordability. At 6-10 RMB, it undercuts rivals (15-30 RMB) but risks diluting taste or alienating upscale buyers.

Regulatory hurdles loom too: Beer sales demand alcohol licenses, hiking franchisee costs, while rural acceptance of craft brews remains unproven. Mixue’s move tests supply chain monetization in high-margin categories—if victorious, it validates low-price quality in beer; if not, it exposes limits in tiered-market diversification.

For H1 2025, Mixue reported 14.87 billion RMB in revenue, with net profit surging 44.1% year-over-year, yet investor concerns over sustained growth persist. Betting on fresh beer seeks a second growth engine, probing whether the “inclusive model” can shatter category barriers.

As Mixue’s red signage pairs with beer taps, a new consumption fusion unfolds—from daytime refreshers to evening social sips, targeting all-day needs. The question lingers: Will patrons grab brews from a lemon water spot? This acquisition could spark a habit shift or fade as hype.

References

- Sina Finance: Mixue Acquires Fu Lu Jia

- Guancha: Snow King Enters Fresh Beer

- Ifeng Finance: 2.97B RMB Deal Details

- Yahoo Finance HK: Cross-Border Acquisition Analysis

- Securities Times: Mixue Sells Draft Beer

- 21 Finance: Post-Coffee, Now Beer

- 36Kr: Layout in Fresh Beer Track