In the first half of 2025, Chinese-made chips achieved remarkable results, with both export volume and value hitting new highs. The total export value reached 650.26 billion yuan in just six months, all earned through tangible overseas sales.

This is a strong counterattack for Chinese manufacturing in the global market. But the key questions remain: Who is buying these chips? For what purposes? And where is the industry chain heading?

Exports Surge by 650 Billion Yuan — No Coincidence

In the first half of 2025, China exported 167.77 billion chips, generating 650.26 billion yuan. According to official data, this represents a solid year-on-year growth of 20.3%, especially noteworthy given the global chip market had just begun recovering.

This is not a short-term rebound but the result of two years of continuous growth. For comparison, in 2024, chip exports reached $159.55 billion, up 17.4% year-on-year. That year, for the first time, chips surpassed smartphones to become China’s top export product, reshaping the country’s export structure.

Behind this momentum lies the industry’s recovery from setbacks in 2022 and 2023, when global inventory cuts and tightening external restrictions caused exports to slump. The turnaround came in 2024, with 14 consecutive months of growth, proving that China’s chip industry not only survived but stabilized and regained capacity.

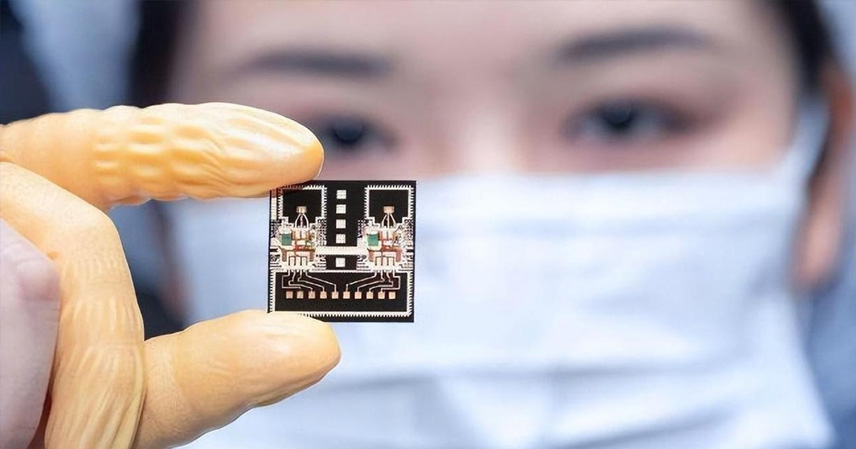

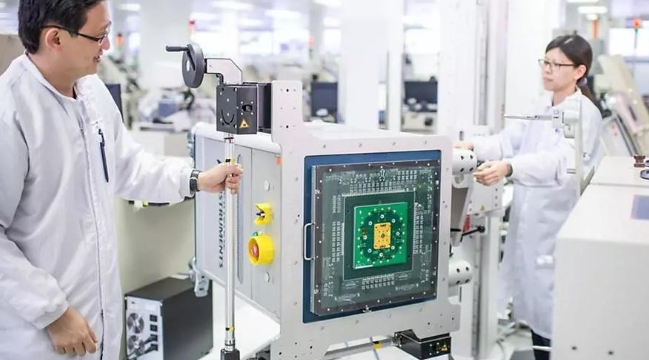

The real driver of this rebound is upgraded manufacturing capabilities. Beyond design, Chinese chipmakers achieved breakthroughs in foundry, packaging and testing, EDA tools, and power devices. Coupled with overseas clients’ reliance on stable supply, many orders once diverted elsewhere have flowed back to China.

Who Are the Major Buyers? Vietnam and India Lead

The biggest buyers are in Southeast Asia and South Asia.

In Southeast Asia, Chinese chips are widely used in smart TVs, set-top boxes, home appliances, and wearables. Thanks to its massive production base, China can ensure stable supply and cost efficiency. In 2024, chip output reached 430 billion units, averaging 1.2 billion units daily.

For example, StarPower Semiconductor’s IGBT chips for EVs exported to Thailand grew by 200% year-on-year, proving China’s ability to deliver advanced components. Meanwhile, the price gap between Chinese exports and imports has narrowed sharply, showing stronger competitiveness.

Vietnam alone ordered $16.48 billion worth of Chinese chips in 2024, up 56% year-on-year, driven by assembly plants for electronics and home appliances. Local chipmaking is absent, so Chinese suppliers became the first choice due to fast delivery, stable lead times, and geographic proximity.

In South Asia, India has become another major buyer. In 2024, chip exports to India totaled $7.47 billion, up 30.3% year-on-year, marking the fourth consecutive annual record. Since 2019, exports have tripled, complementing India’s push for local phone assembly — a sector dependent on imported chips.

These trends show that China’s chips are not bought out of goodwill but because they are technically competitive, cost-effective, and reliable in supply.

A Decade-Long Turnaround: From Weakness to Strength

In 2013, China’s chip imports first exceeded $200 billion, highlighting a heavy dependence on foreign supply. By 2014, annual domestic output surpassed 100 billion units, though mainly low-end. Exports were then a side business, not a main revenue source.

The turning point came in 2018 when ZTE faced a crippling U.S. ban, exposing China’s vulnerability. By 2019, the second phase of the National IC Industry Investment Fund and the STAR Market launch channeled massive capital into chip companies. Firms such as SMEE and Montage Technology leveraged this funding to scale up.

Over the following decade, China built up its design, manufacturing, packaging, EDA, and power chip ecosystems, transforming itself from follower to competitor.

By 2024, chip exports surged 18.7%, and by mid-2025, had already reached 650.26 billion yuan. This progress was not speculative but built step by step through products, production lines, equipment, financing, and steady market demand.

Today, China’s chip exports stand as a testament to ten years of resilience and industrial upgrading. The 650.26 billion yuan export figure represents hard-earned global market trust, proving that China is no longer a dependent buyer but a reliable supplier.

References

- Official trade statistics from 2024–2025 reports

- China Semiconductor Industry Association data