Since Donald Trump took office, American farmers have faced one crisis after another.

According to Reuters, a Brazilian agriculture official confirmed that China has officially approved sorghum imports from Brazil, with the first shipments expected later this year. This creates an alternative supply option to replace U.S. sorghum.

China Approves Brazilian Sorghum Imports

For years, the U.S. was the dominant sorghum supplier to Asian countries, with China as its largest buyer. Nearly 90% of China’s sorghum imports once came from the United States, particularly for use in baijiu (Chinese liquor) production and animal feed.

For many U.S. farmers, sorghum has been as critical as soybeans. That’s why the news hit hard. Craig Meeker, a Kansas farmer and former chairman of the National Sorghum Producers, lamented:

“It took us 15 years to build a reliable market in China, and now it’s all gone.”

Soybeans Already in Crisis

The pain for U.S. farmers doesn’t stop with sorghum. Soybean producers are already struggling.

Since Trump’s tariff policies took effect, China has gradually reduced purchases of U.S. soybeans and deepened cooperation with Brazil. Now, U.S. soybean imports to China have nearly collapsed to zero.

As America enters its soybean harvest season, farmers are facing an awkward reality: no buyers.

Billions in Lost Orders

Analysts say that without Chinese purchases, U.S. soybean exporters have missed out on billions of dollars in sales. Farmers are in a dire situation.

Meanwhile, the sorghum crisis is accelerating. Last year, nearly 90% of U.S. sorghum was exported to China. But by July this year, U.S. sorghum exports to China had fallen from 1.4 million tons to just 82,000 tons—a staggering 95% drop.

Now that China has secured Brazil as a replacement supplier, U.S. sorghum exports may soon fall close to zero.

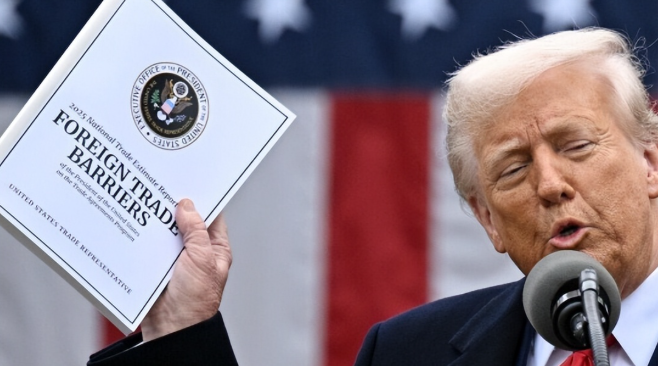

Trump’s Trade Policy Backfires

The damage is largely self-inflicted. For years, Washington treated agricultural products as bargaining chips in trade disputes. But this left China wary of relying on unstable U.S. supplies.

Even if tariffs were rolled back, trust has already been broken, making a return to pre-trade-war levels unlikely.

At the same time, Brazil offers better value:

- Lower land and labor costs

- Strengthened agricultural cooperation with China

- Improved ports and logistics systems boosting efficiency

As a result, Brazilian sorghum is not only cheaper but also more reliable. China has every reason to shift away from American suppliers.

China Diversifies, Brazil Rises

Ironically, while Trump’s tariffs hurt Chinese-U.S. trade, they accelerated China’s search for safe and diversified alternatives.

By signing sorghum contracts with Brazil, China has:

- Reduced reliance on U.S. agricultural imports

- Strengthened ties with South America

- Expanded international cooperation opportunities

In short, what was meant as U.S. leverage has instead weakened America’s bargaining power.

Conclusion

Trump once hoped tariffs would pressure China into concessions. Instead, they have backfired—hurting U.S. farmers most of all.

Both soybeans and sorghum, once pillars of U.S. agricultural exports to China, are rapidly losing market share. Farmers who spent 15 years cultivating ties with Chinese buyers are now watching their market vanish—replaced by Brazil.

References

- Reuters: China approves Brazilian sorghum imports, first shipments expected this year

- U.S. National Sorghum Producers statements via industry media reports