The Chinese chip industry has experienced its share of ups and downs in recent years, and the fall of Tsinghua Unigroup is a classic example. From a period of immense success to a sudden collapse, the process has been a source of much reflection.

Zhao Weiguo, originally a talented graduate from Tsinghua University, made his fortune in real estate before entering the chip industry. His rapid rise, followed by a dramatic downfall, not only marks a personal tragedy but also highlights the challenges China faces in its pursuit of independent chip development.

Let’s start with Zhao Weiguo. Born in 1967 in the remote Shaanxi County of Xinjiang, Zhao was an outstanding student who was admitted to Tsinghua University in 1985, majoring in radio electronics, which is now the Department of Electronic Engineering. He graduated in 1989 and completed his master’s degree in 1996.

After graduating, Zhao didn’t immediately pursue research. Instead, he joined Tsinghua Unigroup, where he became the deputy general manager of the Automation Engineering Division. After a few years, he moved to Tongfang Holdings, another Tsinghua-linked company.

Around 2000, Zhao started his own ventures, investing in real estate in Xinjiang, a region where the industry was just beginning. He invested in a few projects, and within a few years, his assets grew to several billion yuan.

In 2004, Zhao established Jiankun Investment Group in Beijing, focusing on equity investments. By 2009, through Jiankun, he acquired Tsinghua Unigroup and became the chairman. This marked the beginning of a new chapter for Tsinghua Unigroup.

Originally founded in 1988 and controlled by Tsinghua University, Tsinghua Unigroup was known for its early successes in self-research, producing products like USB drives, input methods, and scanners, earning a solid reputation in the high-tech industry.

However, after Zhao took the helm, the company’s approach changed dramatically. Instead of focusing on slow and expensive research and development, Zhao adopted an aggressive strategy of mergers and acquisitions. Starting in 2013, Tsinghua Unigroup began a spree of acquisitions.

First, it acquired Spreadtrum Communications for hundreds of billions of yuan, followed by the acquisition of RDA Microelectronics in 2014, and in 2016, it invested in the storage chip project, Yangtze Memory Technologies.

In just a few years, Tsinghua Unigroup acquired over 20 companies, with its assets skyrocketing from 13 billion yuan to 297.8 billion yuan in 2019, making it a giant in China’s semiconductor industry. Zhao’s actions were seen as bold, but many in the industry believed he was simply burning money to increase scale.

The most famous incident occurred in 2015 when Zhao visited Taiwan and boldly claimed he would buy 25% of TSMC’s shares, taking control and merging its chip design business with MediaTek, calling for Taiwan to ease restrictions on Chinese chip investments.

This statement caused an uproar in Taiwan, with TSMC’s chairman Morris Chang flatly rejecting the idea, calling it a pipe dream. Zhao’s remarks highlighted a key issue: China’s chip industry was dependent on foreign technology, and the core technologies were still controlled by others. Instead of developing these technologies domestically, China was trying to acquire them.

In the end, Zhao didn’t manage to buy TSMC, and Tsinghua Unigroup continued to push ahead with its projects in mainland China, including investing in Yangtze Memory Technologies and Hefei Changxin’s DRAM project, hoping to become self-reliant in memory chips. However, many of these projects were funded by government-backed funds and bank loans, with Zhao himself contributing very little of his own money.

While expansion looked impressive, significant risks were hidden beneath the surface. Tsinghua Unigroup’s acquisitions were funded by massive debt—bank loans and bonds—leading to a frighteningly high debt ratio. By 2018, the company had assets exceeding 200 billion yuan, but its debts were piling up.

During Zhao’s leadership, Tsinghua Unigroup became the largest player in China’s integrated circuit industry, but internal issues grew more pronounced. Research and development investments were insufficient, mergers and acquisitions were poorly integrated, and the company remained reliant on foreign technology.

In November 2020, the company defaulted on its first bond, signaling the collapse of its financial structure. Creditors began chasing debts, and banks froze accounts. On July 9, 2021, creditors filed for bankruptcy reorganization in Beijing, and by July 16, the court accepted the petition.

The restructuring process was chaotic, with multiple investors bidding for the company. In December 2021, the restructuring was finalized with a 60 billion yuan investment, and the company’s new management took over. Tsinghua Unigroup was no longer under Zhao’s control.

The collapse of Tsinghua Unigroup had a significant impact on China’s chip industry. For years, China had loudly touted its ambition to develop its own chips, with the government investing billions through large funds.

But Tsinghua’s model revealed critical flaws: relying on mergers to scale up without focusing on core technological development would eventually lead to failure. Zhao’s strategy of rapid expansion didn’t address the technological gap, and when faced with economic downturns or U.S. sanctions, it couldn’t hold up.

After the U.S.-China trade war, Huawei and ZTE were targeted, and Tsinghua Unigroup was also affected, with foreign acquisitions becoming increasingly difficult.

Post-bankruptcy, the new Tsinghua Unigroup changed its approach, focusing on industrial chain collaboration with companies like FAW, Zhejiang University, and Beihang University. It has since shifted its focus to storage, communications, and the Internet of Things, with its self-research ratio improving.

By 2025, when the new Tsinghua Unigroup marks its third anniversary, it claims to have made progress in storage, communications, and IoT, with an increasing proportion of self-developed products.

China’s chip industry cannot always rely on shortcuts. Zhao’s journey, transitioning from real estate to chips, was a cross-industry move, but he failed to focus on technology and instead focused on capital operations, ultimately leading to his downfall. Many in the industry now reflect on the importance of self-research, understanding that it’s a long-term effort.

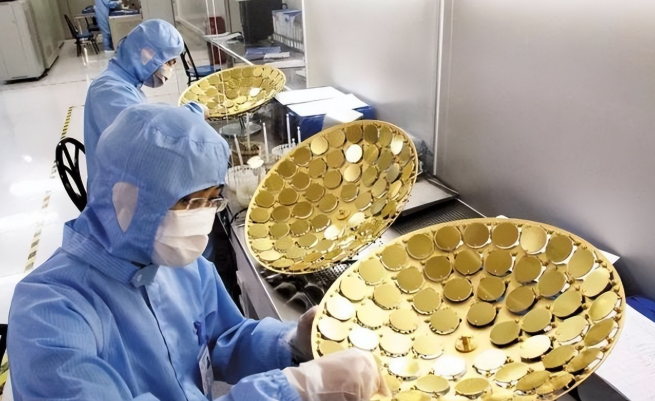

Like Yangtze Memory Technologies, which has seen progress in 3D NAND, and Hefei Changxin’s DRAM, which is beginning mass production, these achievements are the result of real work. National policies have also shifted, with new guidelines emphasizing the development of the integrated circuit industry and encouraging companies to become self-reliant.

The old model of Tsinghua Unigroup collapsed, and the new model is still testing the waters. Whether China can catch up in the chip industry will depend on its investments in research and talent accumulation.

Conclusion:

Tsinghua Unigroup’s bankruptcy exposed the “shame” of China’s chip industry. The company’s massive assets and position as an industry leader were shattered with a single blow.

Relying on mergers, hollowing out technology, and a fragile financial chain are weaknesses in global chip competition. With the U.S. blocking high-tech equipment, Chinese companies must innovate on their own.

Companies like Unigroup Guo Wei are now focusing on smart security chips, special integrated circuits, and FPGAs, with performance on the rise, but the overall industry still has a long way to go. The chip industry is capital-intensive with slow returns, requiring patience. Zhao Weiguo’s pursuit of quick success serves as a warning for others.

References:

- China Semiconductor Industry Report, 2024

- U.S.-China Trade War and Its Impact on Chinese Tech, 2020